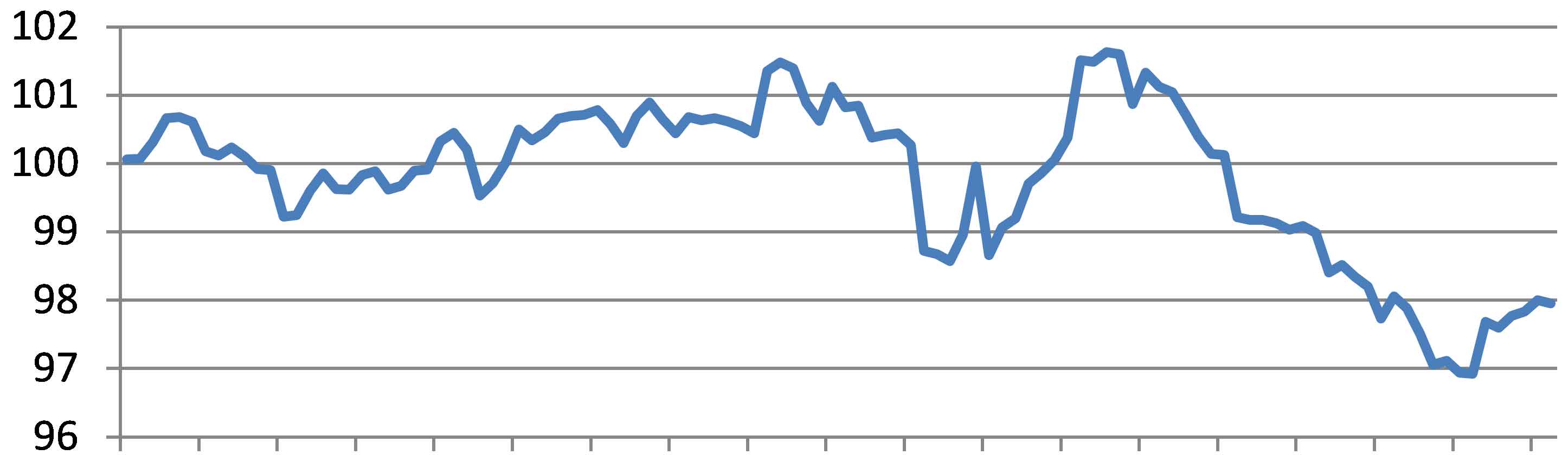

Global PE markets have been on a firm trend for almost three months on the back of higher costs and supply issues, as per the pricing service of ChemOrbis. However, energy markets witnessed a sudden, sharp decline this week. Hence, players are now questioning whether this bearish development will make itself felt on October pricing. October crude oil futures on the NYMEX posted successive daily losses this week and dipped as low as $90/bbl in Thursday’s electronic trading, only a week after futures briefly moved above $100/bbl before settling at $99/bbl on September 14.

This plunge was mainly attributed to rising stockpiles in the US stemming from the arrival of imports and the resumption of oil production in the Gulf of Mexico after Hurricane Isaac. Doubtful economic prospects have also played a role in the notable decreases on crude oil prices. Earlier in the week, the Federal Reserve Bank of New York’s general economic index reached a three-year low, indicating possible weakness in demand, while Chinese manufacturing shrank and Japanese exports fell, according to reports that came in later in the week.These reports signal that fuel demand may be slowing among the world’s biggest crude oil users.

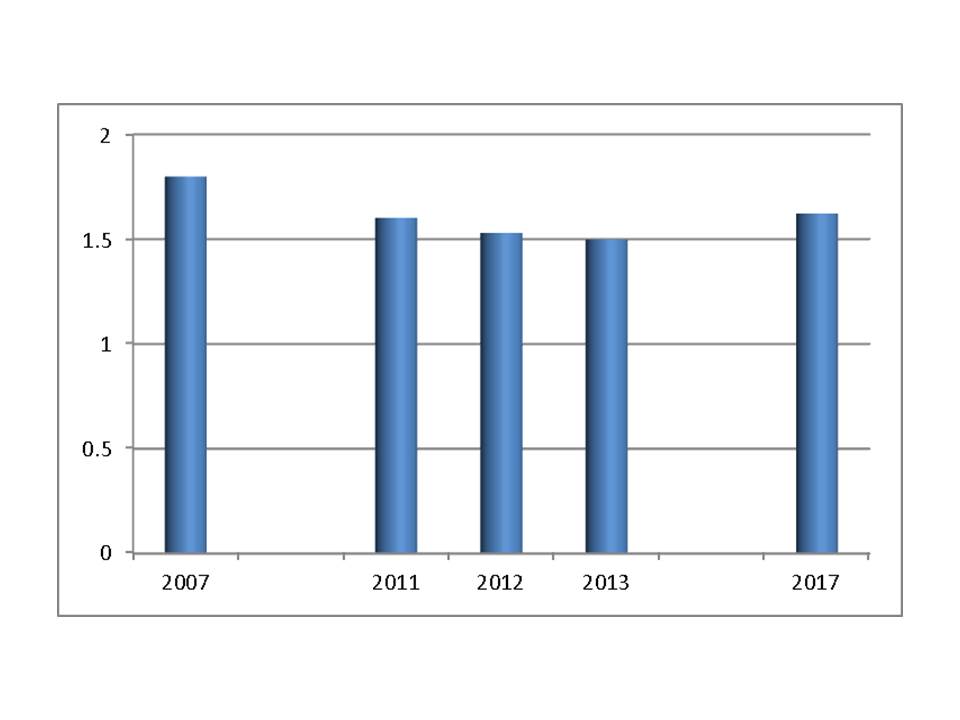

The naphtha market also already responded to the large decreases in crude oil prices. Both in Asia and Europe, spot naphtha values were trading at around the $1000/ton threshold last Friday. However, values in both regions have lost $85-90/ton this week as Asian prices fell to $915/ton CFR Japan as of Thursday while Europe was trading below $910/ton CIF NWE in the middle of this week.

These bearish developments in energy markets have occurred at a time when players have been trying to determine the outlook for October in the PE markets.

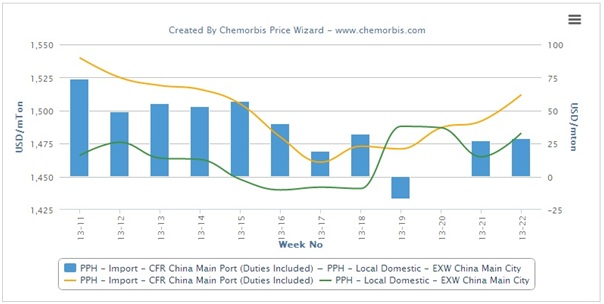

In Asia, regional and overseas producers have approached the Chinese market with further hike requests for October. The US Federal Reserve’s announcement of a third round of quantitative easing also helped buoy market sentiment. Sellers are maintaining their firm stance for now as they want to improve their margins. However, a distributor based in Shanghai told ChemOrbis, “Most buyers are hesitant to purchase in large quantities ahead of the upcoming Chinese National Day holidays.”

The Southeast Asian PE market also witnessed higher import and local prices this week. “We raised our own prices in accordance with our suppliers’ price hikes, although we are concerned that buyers may offer resistance to these new price levels,” a trader based in Vietnam reported.

In Europe, some easing has already been seen in spot LDPE and LLDPE prices as buyers’ resistance is growing against high levels. An increasingly large number of buyers think that PE prices are nearing the peak in Italy. Buyers either prefer to secure their minimum requirements or delay their purchases if their stocks enable them to wait. According to a distributor, regional producers will ask for some hikes for October in order to ensure a stable to firm trend on the back of ongoing shutdowns at crackers and PE units. Nevertheless, some players argue that supply is not so tight, particularly for LDPE and LLDPE. Thus, buyers do not think that the three month long upward trend will be maintained in October given persistently poor demand and the recent plunge in energy costs.

Similarly in Turkey, both distributors and buyers commented that the current price levels are unreasonable considering unsupportive demand.