Brazil’s plastic recycling rate fell from 25.6% in 2022, the best year on record, to 20.6% in 2023. It is the worst result since records began in 2018 in the South American country.

MaxiQuim, a business valuation company in the chemical industry, compiled the data at the request of the Plastics Chain Incentive Plan (PICPlast, from the Portuguese), a partnership between the Brazilian plastic association (Abiplast) and the Brazilian petrochemical giant Braskem.

Data shows that the Brazilian plastic recycling industry consumed 1.45 million tonnes of plastic in 2023, a 14.7% decrease from 2022. Of these, 467,000 tonnes originated in post-industrial waste (335 tonnes), and post-consumer waste, such as consumer durables (87 tonnes). Rigid and flexible packaging as well as disposable packaging accounted for 984,000 tonnes, representing 68% of the total. The recycling rate for plastic packaging was 24.3%.

“When we compare last year’s indices with 2018, the year this study began, we see that the overall index fell by 1.5 percentage points,” said Maurício Jaroski, director of sustainable chemistry and recycling at MaxiQuim. “This variation was mainly due to the industry losing momentum in the growth of recycled plastic volumes, due to the devaluation of the prices of virgin resins, which are more attractive to producers,” he explained.

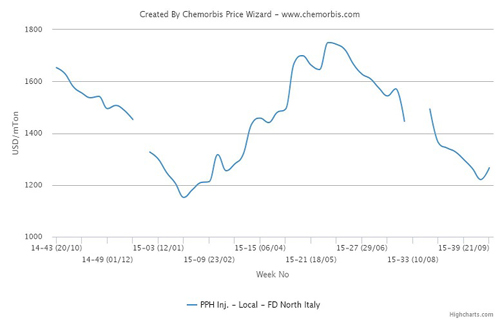

Recyclate prices in Europe have also been under severe downward pressure for the past two years. Persistent weak demand caused by economic stagnation and competition from the falling cost of off-spec virgin plastics and cheaper imported recyclate has seen recyclers reduce production volumes.

This reduction in production volumes has also affected revenues for the Brazilian plastics recycling industry in 2023. Gross sales declined to BRL 3.79 million (€616,307), down 19.8% from the previous year. Jobs also fell to 18,601, 1.5% lower than in 2022. Nonetheless, installed capacity increased 3.5% to 2,385 kilotons thanks to investments finalised in previous years.

“These capacity expansions overlapped with the closure of some companies during the year, contributing to an increase in the sector’s consolidated installed capacity,” MaxiQuim’s report reads.

There were 698 plastic recycling companies in Brazil in 2023, down from 711 in 2023. The peak was in 2018 with 716 companies, with the following years seeing a steady decline with the notable exception of 2022.

The most recycled plastic was PET with a rate of 47.9%, followed by HDPE (28.1%), EPS (25.6%), PP (17.2%), others (12%), PVC (10%), LDPE (8.8%), XPS (8.1%), and PS (6.9%).

Brazil produced 939,000 tonnes of post-consumer resign (PCR), with rPET accounting for 41.1%, followed by rHDPE (20.6%), rPP (16.9%), rLDPE/rLLDPE (14%), PS (2.4%), EPS (1.5%), and others (0.9%).

These recycled resins were transformed into products for the food and beverage industries (16%); construction and infrastructure (13%); personal hygiene, cosmetics and household cleaning (12%); household utilities (8%); automotive (7%), amongst others.

“Due to a year of challenging appreciation of recycled resin, the construction and infrastructure segments, which are traditionally lower value-added segments, increased their demand for PCR plastic,” Jaroski explained.

Source: sustainableplastics.com