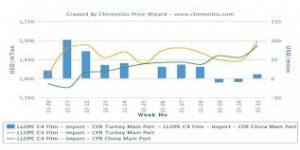

Widespread talk about a new round of PE hike attempts arose among buyers and traders in Turkey this week. Many players reported that a major Saudi Arabian producer is set to issue increases on their September offers with a different regional producer already voicing their sell ideas with $30/ton increases over August. Additionally, some players anticipate that higher PE prices may emerge from Europe on the strength of higher expected ethylene contracts in the region, according to ChemOrbis.

Several packaging converters reported that they were informed by their regular Saudi Arabian supplier that the producer plans to lift their PE prices for next month. The buyers said that they did not feel an urgent need to purchase given their sufficient stocks and discouraging end product orders. The converters predicted that demand, which lags behind expectations with the exception of LDPE, for which supply is short, would allow the producer to approach the market with hikes of around $20-30/ton maximum.

A buyer commented, “A Saudi Arabian major is planning to raise their LLDPE offers by around $20/ton. A different global source is said to be having PE supply constraints nowadays.” He expects to see higher prices in the coming days as Turkey does not carry a premium over China. “However, I am not sure about how much the market can move up under these sluggish demand conditions,” he added. A second packaging and bag converter expects to hear a $30/ton hike from the same producer, while a third packager said, “I believe that the producer may return the market a bit later than usual with new announcements. I do not think they will issue large hikes of $50-60/ton but they may seek smaller increases of around $20-30/ton. While their hike amount is uncertain, we are confident that they will lift their prices from August.”

Meanwhile, another Saudi Arabian producer voiced their new sell ideas with $30/ton hikes for LDPE film. “Our HDPE offers are not attracting much interest while there is some demand for LDPE due to short supply for this product. In general, demand is good and we are hopeful of better demand in the coming month as buyers purchased less than their normal quantities over the past month and will need to restock,” a producer source reported.

In addition to firmer talks regarding Middle Eastern PE prices for September, higher spot ethylene costs may push new monomer contracts up in Europe, which could drive European PE prices higher. Indeed, a trader offering on behalf of a South European supplier commented, “We have sold out our August allocations and are now considering our September prices. Our principal is considering lifting their PE prices by €60-100/ton. We believe that we will not be able to offer any LDPE for September.”

A distributor reported, “Prices may firm up a bit more in the near term as European monomer contracts are likely to settle higher for September. However, we don’t expect to see vivid demand,” according to ChemOrbis sources.