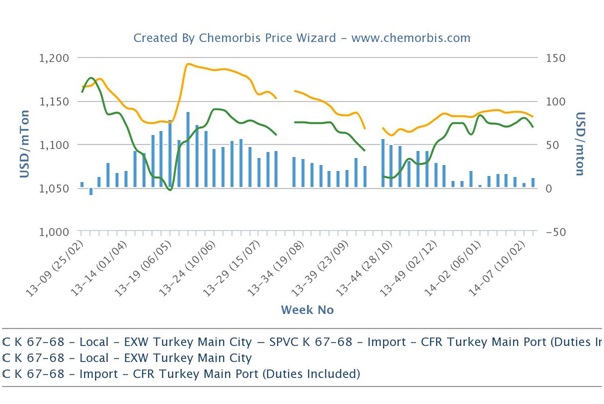

According to ChemOrbis Price Index, Turkey’s locally held PVC k67 prices have been almost steady on average since the beginning of 2014. Even though demand remains subdued and supply remains comfortable in the localmarket, distributors are not rushing to make aggressive sales. This is because locally held offers have already been trading with little or even no premium over imports.

Having secured cargoes in December and January, buyers are not rushing to make new purchases owing to the slow season that has been in place. They are mostly shying away from imports and prefer to meet their urgent requirements from the local market, where supply remains already sufficient.

The lack of buying interest from Turkish buyers caused traders of US materials to back off larger hike targets in the import market in late January. Some easing was even visible in the past weeks right after the settlement of February ethylene contracts with €40/ton decreases.

Some US traders were believed to be holding previously purchased positions for PVC. Even though American producers’ new export offers have been steadily edging up, Turkish players were still able to find lower priced US cargoes. Once these older positions are sold out, some traders believe higher PVC prices are on the way for new shipments since US suppliers have very limited allocations amidst their own tight supply and stronger domestic market.

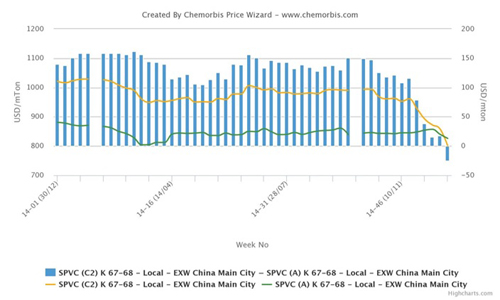

Asian PVC markets returned from the Chinese New Year holiday on a firm note too. A major Taiwanese producer revealed its March prices to China with $20/ton increases in line with their sell ideas. This was followed by other overseas producers in the midst of firm VCM prices and tight supplies.

The European PVC market, meanwhile, is facing lower done deals in February, although some sellers are hopeful about a recovery in demand across the continent next month in line with the high season for PVC applications.

Accordingly, seeing no clear downward pressure from the global markets, Turkish distributors are holding their PVC offers steady in the local market but they cannot apply increases either as per ChemOrbis. They are squeezed between their replenishment costs and weak local dynamics.

PVC players are meeting at the Turkey PVC Conference tomorrow to have a better understanding of the global markets and to gain networking opportunities. To view the venue, agenda, list of attendees or to register now for the Event, please see ChemOrbis Turkey PVC Event Web Portal.