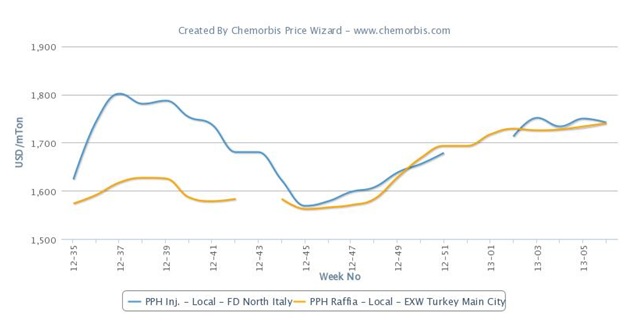

Turkey’s local homo-PP market typically trades below the Italian market. For the period to date in 2013, the local markets of these two countries are trading almost on par, according to the average price on ChemOrbis Price Wizard. The local market levels include customs duties when applicable, clearing and handling costs and distributors’ margins.

This week, the price difference when calculated based on USD is at just $3/ton. For the period of September to mid-October 2012, the premium that the Italian market carried over Turkey was around the range of $50-150/ton, with the premium figure over $100/ton for most of that time. With the current conditions it is not surprising that European origins have become a viable option recently in the Turkish import market. West and South European offers when converted to USD with the recent parity are currently offered into Turkey at or below the low end of non-European origins, after adding customs duties of 6.5%.

A major Saudi Arabian producer had approached the Turkish market with a $100/ton increase at the start of the month. Though this offer has been revised down, other non-European origins had come with increases of at least $30-40/ton for the month. These global producers were eyeing the Chinese market, which had been relatively strong before the New Year holiday and they were expecting March offers to rise after the holiday.

In Italy, sellers had come with increases of €50/ton at the start of the month, but have since stepped back to asking for rollovers or increases of €10-20/ton. Demand in the country is said to be poor, especially as buyers wanted to wait in the beginning to see if prices would be adjusted. Players also feel there is comfortable supply. One compounder believes that distributors’ warehouses are full because of the sluggish demand, while another also believes supply is ample on the distribution side because sellers stocked up before the Christmas holidays due to the bullish sentiment regarding the January outlook. Price hikes were already being discussed for January during the month of December.

Looking at historical prices on ChemOrbis Price Wizard, it is seen that the premium Italy’s local PP market carries over Turkey is fairly consistent. At times when the premium was lost, Italy’s market tended to bounce back up again to regain its position above Turkey’s local market. For now, the outlook for Turkey remains firm despite complaints about the demand situation from sellers and buyers’ complaints of high prices. Spot propylene prices in Asia and Europe were up last week and energy markets had risen. Global producers have been planning for higher prices in China once the holiday ends. Players will be watching for China’s reaction, however, once the holiday ends next week.