Founded in 1942, Supreme Industries Ltd (Supreme Ind) is a recognized leader of India’s plastics industry and handle volumes of over 100,000 tonnes of polymers annually, effectively making it the country’s largest plastics processors.

We have earlier recommended “SUPREME INDUSTRIES LTD” in our Weekender report dated 3rd Feb’12, at the then price of Rs.174.90 with a Target Price of Rs.242.0, providing an upside of 38%. The stock has reached our target on 20th July 2012 when it touched Rs.245.

Pioneering several products in India: Strong demand from User industries to fuel growth

Supreme Ind. is credited with pioneering several products in India. These include Cross-Laminated Films, HMHD Films, Multi-layer Films, SWR Piping Systems, PP Mats and more. Pipes made by Supreme Ind. find extensive use in irrigation, bore-wells, portable water supply, plumbing, drainage, underground sewerage, rain-water harvesting and water management.

Managed to hold margins at a steady rate: margins to improve going forward

While operating profit margins from segments such as Pipes and Packaging are vulnerable to raw material cost increases, Supreme Ind. has managed to hold its EBITDA margins at a steady 13-14% range in recent years. The EBIDTA margin for FY12 was the highest in the last 6 years at 14.8% due to increase in production, increase in value added products, inventory gain and due to finished goods (it is valued at historical cost, thus benefited with rising raw material cost.

Riding on new capacity + Expansion plans are on full swing: Phase-I to be operational by Oct’2012E

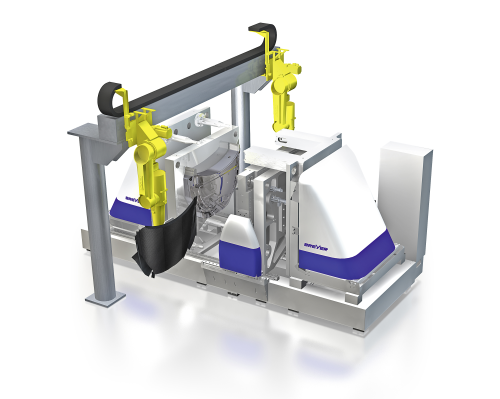

The company’ new unit at Hosur (Tamil Nadu) for protective Packaging Products is likely to be operational by end of Sept’12E. Construction of building at new unit for expanding capacities of Cross Laminated Film at Halol (Gujarat) is in full swing and key equipments have started arriving. The management has guided that part of the Phase-I capacity expansion of 12,000 MT p.a is likely to be operational by Oct’12E. Moreover, the 500,000 composite cylinders facility at Halol (in the same unit) is likely to be operational during Jan – Mar 2013E.

Aims to grow business by 16% in volume in FY13E

Supreme Ind. sees volume growth of plastics in the country between 10%-12% in FY13E. However, the company is aiming to grow its business by 16% in volume in FY13E and expects to grow by ~25% in value.

Positive Guidance for FY13E

The value added products contribution has gone up from 29.3% to 30.05% for FY12. The value added product’s volume in consumer products to grow at 8% in FY13E as compared to 6% in FY12.

After composite cylinder, the company is exploring business of composite pipes which are used in oil drilling due to long life compared to metal pipes which has just 5 years. It is also looking at 2 new products in composite area.

Consistent Dividend payout & Bonus History: Avg. Dividend rate of 82.5% over last 12 years

At the CMP of Rs.239, the stock is trading at 10.5x its FY13E EPS of Rs.22.81. We recommend BUY on the stock with a 12-18 months target price of Rs.297, providing an upside of 24% from the current levels.