The Oct. 14 announcement blamed weakening demand, which the company said is down 50 percent in 2024.

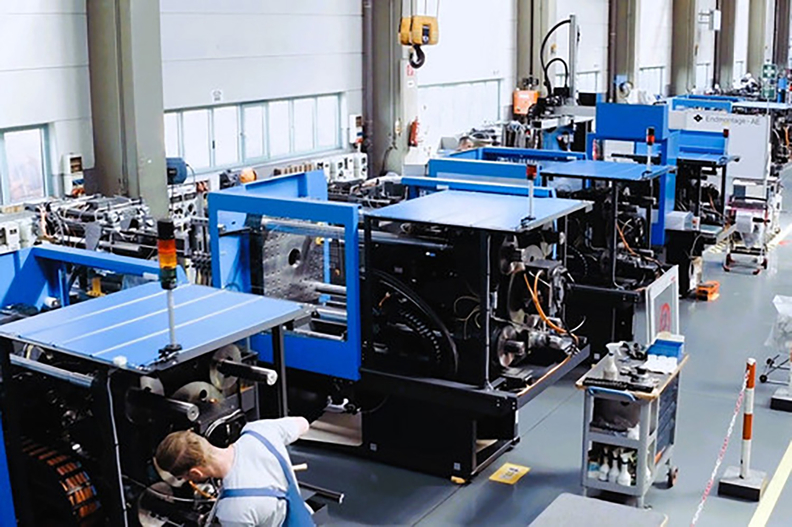

Plastics processors in the automotive, electronics and construction industries haven’t been investing in their machine fleets, according to CEO Christian Maget.

Sumitomo management had made a solidarity pact with its workers council at the two German sites in Wiehe and Schwaig in 2020. The agreement led to a voluntary waiver of bonuses by the entire management team and all non-pay-scale employees as well as the introduction of temporary short-time working for all employees.

The pact helped the company retain its workforce and adjust overall capacity to increase immediately when demand called for it.

However, conditions remained challenging with international conflicts and key markets struggling, particularly automotive, electronics and construction.

“After four years of market crisis and the disappearance of important markets such as Russia, our strong increase in market share and our positioning as market leader for fully electric machines are no longer sufficient to compensate for this market crisis,” Chief Sales Officer Anatol Sattel said.

“We do not see any current market recovery in the mentioned sectors either this or next year. Since the market crisis in the injection molding machine sector is not limited to Germany, but affects large parts of Europe, the USA and China, we can no longer compensate through our international business,” Sattel said.

Machine builders are struggling in Germany, where orders for plastics and rubber machinery haven’t yet “bottomed out,” according to the mechanical engineering industry association VDMA.

VDMA expects a 10-15 percent drop in plastics and rubber machinery sales in 2024 compared with last year. Sales were down 7 percent between January and August, the group says.

At Sumitomo, management will focus on engineering and automation expertise in Germany and reducing simpler production tasks.

Maget said this was always the strategic direction being taken.

“There is a clear competitive advantage for basing our areas of expertise in these production-experienced locations and benefiting from established supply chains,” he said. “The current market challenges have simply urged us to re-evaluate and pull these plans forward by a couple of years.”

Sumitomo officials say the strategic synergy between the company’s Japanese headquarters and production sites in China will create some benefits from “this new production framework,” including the ability to adapt to changing market conditions more fluidly and still expand its global reach.

“This gives us a distinct strategic and customer-focused advantage as it allows for agile production and localized automation and mass-customizations based on customer and service demands,” Sattel said. “Although the archetype model for building machines is constantly changing, all-electric remains our competitive and efficiency advantage.”

Sumitomo (SHI) Demag is a unit of Tokyo-based Sumitomo Heavy Industries Ltd.

Source: sustainableplastics.com