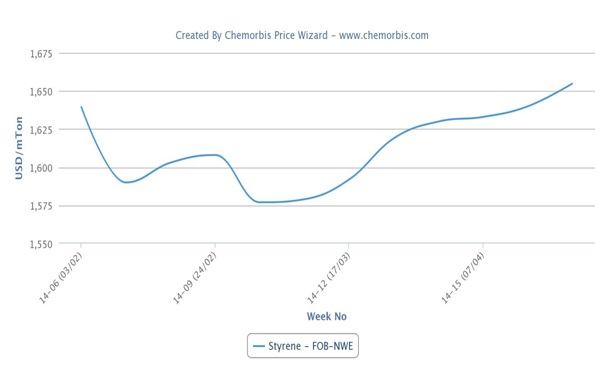

Spot ethylene prices posted decreases both in the US and Europe this week, with the US market witnessing a larger drop compared to Europe as per the pricing service of ChemOrbis. Sluggish demand from the downstream markets and sufficient ethylene supply were cited as the main reasons behind these decreases.

Spot ethylene prices on an FD NWE basis declined by €15-20/ton compared to last week, weighed down by sufficient availability and softer spot naphtha costs which remain below the $900/ton threshold after posting a weekly drop of $15-20/ton. Repsol shut its Tarragona cracker in Spain for maintenance on October 1.

The 700,000 tons/year cracker is expected to remain offline for 40 days. Ineos’ No 5 cracker in Cologne, Germany is currently undergoing a 2 month long turnaround and SABIC’s Olefins 4 cracker at Geleen, Netherlands is also offline for maintenance that started in the middle of September. Despite the heavy turnaround program in the region, supply is not considered short.

In the US, spot ethylene prices on an FD USG basis have slumped by 6 cents/lb ($132/ton) on the week weighed down by weak demand from the downstream markets as several PE producers have experienced production issues over the past weeks.

LyondellBasell declared force majeure on the HDPE supply from their 695,000 tons/year Matagorda, Texas plant on September 12 due to technical problems. It remains unclear when the force majeure will be lifted. Following LyondellBasell, Formosa Plastics also declared force majeure on the output from their HDPE-II unit in Point Comfort, Texas after a fire broke out on September 13. Market sources reported on October 3 that the 650,000 tons/year plant resumed operations and it was running at full capacity.

Chevron Phillips Chemical briefly shut one of its PE units at its Cedar Bayou complex in Texas on October 2, according to sources. According to ChemOrbis, the company operates a 270,000 tons/year HDPE, a 190,000 tons/year LLDPE and a 280,000 tons/year LDPE plant at Cedar Bayou. At the end of August, ExxonMobil Chemical declared a sales allocation on the HDPE supply from their Baton Rouge, Louisiana plant due to a disruption in ethylene supply.