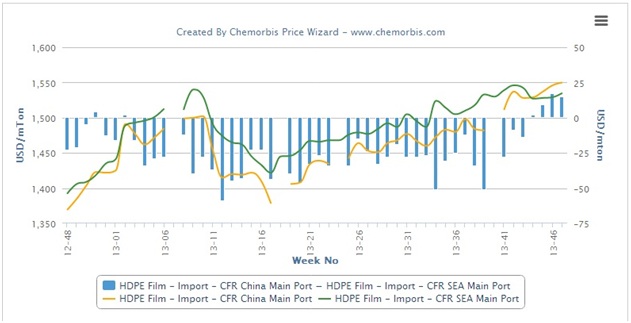

Southeast Asia’s HDPE film market has lost its traditional premium over China as demand from the Chinese market has remained firm while buying interest from Southeast Asia has been disappointing. According to data from ChemOrbis Price Index, import HDPE film prices on a CFR SEA basis had traded with a premium of around $20-60/ton compared with import HDPE film prices on a CFR China basis for most of the past year.

However, China’s HDPE market has been following a steady upward trend since May on the strength of limited supply and healthy demand, allowing the Chinese market to reach par with Southeast Asia at the start of November. In the succeeding three weeks of this month, China’s HDPE market has traded with a premium of around $10-20/ton over Southeast Asia. The past three weeks represent the first time that China’s HDPE market has held a premium over Southeast Asia for more than two consecutive weeks since November of 2011.

A source at a South Korean producer said that they raised their HDPE film and yarn prices by $10/ton on a CFR China basis. “We managed to conclude deals at our new prices and we plan to divert more of our allocations to China to take advantage of the attractive margins available in the country,” the source reported. A trader based in Cixi said that they are unwilling to negotiate on their prices given their limited availability.

According to ChemOrbis, a trader based in Malaysia stated that they are offering 1,000 tons of South Korean HDPE film to China. “We are not interested in offering to Southeast Asia as demand from China is stronger. The fourth quarter is generally a slow season in Southeast Asia and we do not expect to see any real changes in the demand situation over the near term,” the trader commented. A trader based in Singapore offering Middle Eastern HDPE film to Southeast Asia said, “Demand is not doing well in the region but tight supply in the nearby Chinese market is preventing prices from moving downward.”