Saudi Basic Industries Corp. (SABIC), one of the world’s top five petrochemical companies, reported a net loss of SR974 million for its first quarter, which ended March 31, against last year’s income of SR6.92 billion during the same period.

Announcing the quarterly report, Mohamed Al-Mady, vice chairman and chief executive officer of SABIC, said the net loss for the quarter is after a “non-cash” charge related to the impairment of goodwill amounting to SR1.181 billion.

Al-Mady pointed out that the continued decline in prices for most petrochemical products and metals led to a decline in profitability during the first quarter of 2009 compared to the same period last year.

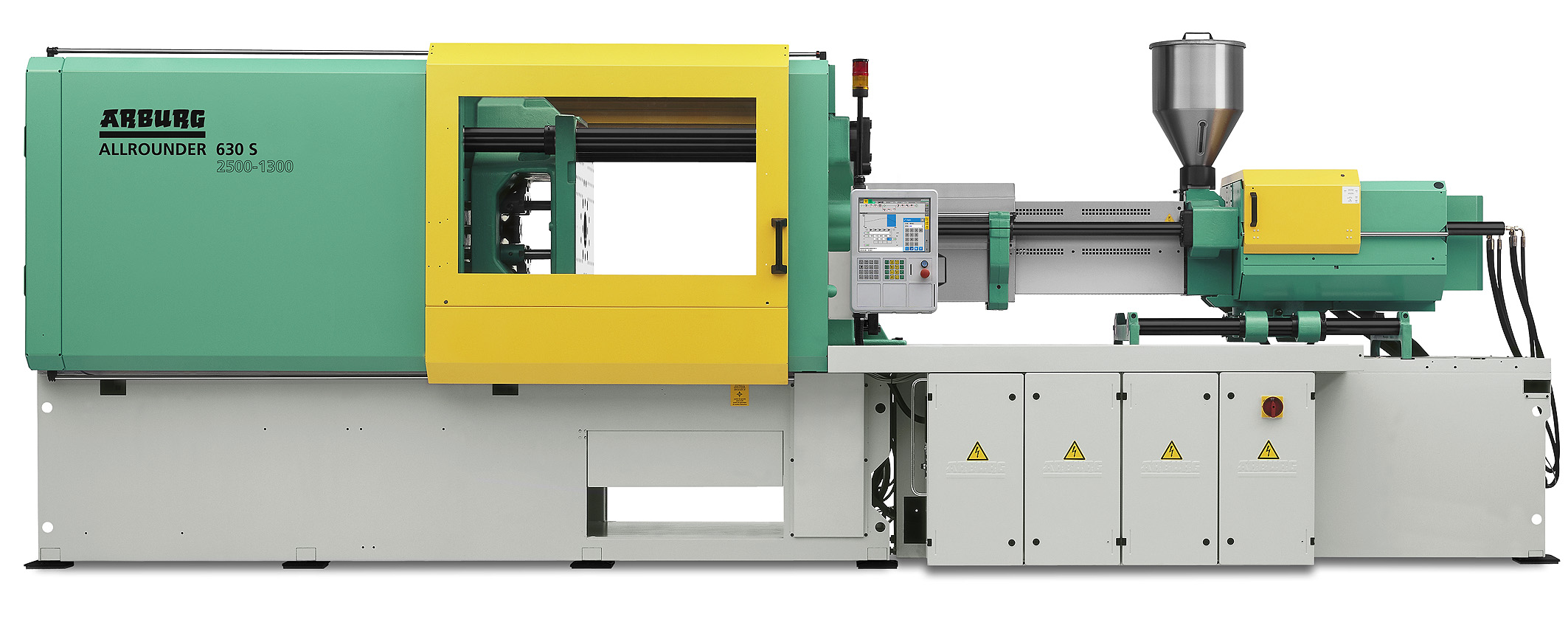

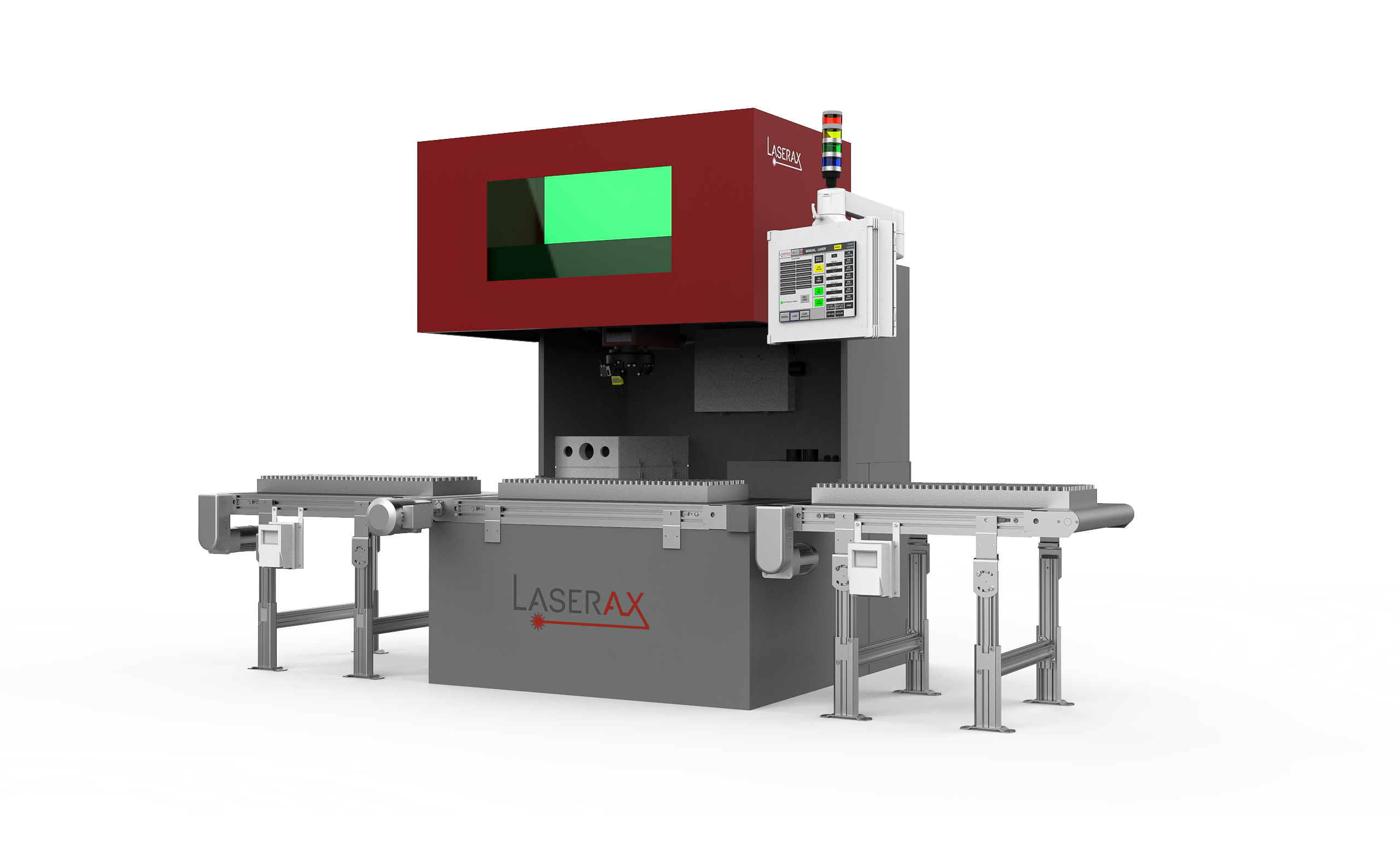

The income from operations for the quarter that ended on March 31 was SR380 million compared to SR10.89 billion in the same period of 2008. The loss per share for the quarter was SR0.33 compared to earnings per share of SR2.31 for the same period in 2008. “The financial and economic crisis that hit the world’s major economies, and the credit crunch have led to difficulties for customers accessing credit facilities from banks and financial institutions. This has contributed to the decline in demand for petrochemical products and metals, in particular engineering plastics, which have been impacted by the recession in the automotive, construction and electronic industries,” said Al-Mady.

He added that these developments have accelerated the pace of decline in the prices of petrochemical products and metals, adversely impacting the performance of global companies, including SABIC.

“In spite of the repercussions of the global economic crisis, which negatively affected the performance of global companies and the petrochemical industry, resulting in bankruptcies, significant losses, closure of a large number of plants and staff demobilization, SABIC has maintained the same operational levels,” he said.

Source: theplasticsexchange.com