The global plastics market has been hit by a perfect storm that’s hurting the supply of the resins used to make everyday goods — including medical gear — and is driving up costs.

Spot prices for U.S. ethylene and propylene have surged, chemicals-maker Dow noted tight inventory levels and producers of medical supplies and the automotive industry are feeling the squeeze.

Britain’s Pentagon Plastics said scarce inputs made it tough to fill orders, including for the medical sector, while Minnesota-based MedSource Labs is struggling to get disposable gloves for the personal protective equipment kits it sells.

“Things that never happened are happening,” said Todd Fagley, MedSource’s chief executive officer. “It’s kind of like the Wild West out there for medical device procurement and manufacturing.”

At the root of the problem lie a series of factors ranging from plants being shut down, the winter storm in Texas and the global shortage of shipping containers — which got thrown off their usual routes due to the pandemic. Add to that the strong economic recovery in Asia and demand for consumer goods in the U.S., and companies are at pains to secure supplies.

‘Warehouses Are Empty’

Derived from crude oil, base chemicals ethylene and propylene, are the building blocks of plastics.

More than 80% of packaging manufacturers face that problem, Germany’s IK sector body said earlier this month. General Manager Martin Engelmann termed the situation “dramatic.”

“It has gotten so far that the warehouses are empty and the first businesses are unfortunately forced to stop production because there’s not enough raw materials. And that’s particularly unfortunate because demand is high — not just for food but also the automobile sector or furniture,” he said.

TecPart, another of the country’s associations, says the price of ABS plastic, used in the automobile industry, has risen 35% over the past six months. The general crunch in plastic inputs isn’t likely to improve before August, General Manager Michael Weigelt said.

Pentagon Plastics is working with suppliers but bracing for a slog.

“The U.K. plastics sector is now experiencing shortages on a scale not seen for some time,” the company said. “This problem it likely to be present for a number of months yet.”

—Catherine Bosley in Zurich

Suez Canal Update

The shipping crisis in the Suez Canal dragged into a third day as tug boats and dredgers worked to free the Ever Given container vessel and allow traffic to resume through one of the world’s busiest waterways for consumer goods and energy supplies. The incident threatens to compound delays and raise costs for an ocean freight market already reeling from shortages of everything from dockworkers to containers. Here’s some of Bloomberg’s coverage:

- Suez Snarl Seen Halting $9.6 Billion a Day Worth of Ship Traffic

- Elite Team Set to Tackle Massive Ship Blocking Suez Canal

- Best Shot at Unblocking Suez Canal May Not Come Until Monday

- What’s Backed Up at the Suez Canal? Live Animals, Oil and Food

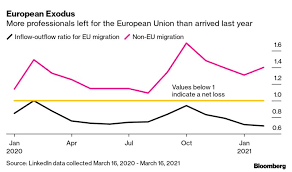

The networking website LinkedIn said its database shows more of its members left the U.K. for the EU than arrived over the past year after the coronavirus and Brexit sent shock waves through the labor market. The exodus from Britain accelerated through the early months of 2021, even as net migration from countries outside the EU remained positive. The findings indicate a broad reshaping of the U.K. workforce that could have implications for the potential of an economic recovery.

Give your small business an easy way to accept touch-free, in-person payments. Create a unique QR code with the PayPal app and display it on your device or as a printout in store. Download the app.

Customer must have PayPal account and app to pay.

Today’s Must Reads

- Speed race | For years, container shipping was a rough business. Margins were minuscule, the risks were high and growth prospects bobbed with the unpredictable tides of global trade. That it’s now generating record profits is one of the great economic surprises of the pandemic.

- Not on a roll | Toilet paper could be the next victim of world’s container crunch as the biggest producer of wood pulp — the key raw material — is warning about possible supply snags.

- Links-to-logistics conversion | The surge in online shopping has developers looking for acreage, and converting old golf courses is proving to be a winning move.

- European worry | When EU leaders meet to begin a two-day video conference, they’ll underscore the severity of the continent’s health situation and the need for member states to continue lockdowns that have roiled the economies of nations trying to curb the spread of Covid.

- New aid round | The Biden administration announced $12 billion in new farm aid, and said it will seek to expand Covid-19 assistance to producers that weren’t covered under the Trump administration’s pandemic-relief programs.

- Wider blitz | Signs that China is taking meaningful steps to rein in aluminum production are a “game changer” for the long-term outlook after years of gluts in the industry, Alcoa’s chief executive officer said. Meanwhile, steel producers are sparring with industries that use the metal as both lobby the Biden administration over the future of Trump-era tariffs on billions of dollars in annual imports.

On the Bloomberg Terminal

- Shipments surge | China’s exports rocketed 60.6% in the first two months of 2021 from a year earlier. Even accounting for the extremely low base in the same period last year when the pandemic first struck, the performance was strong, Bloomberg Intelligence writes.

- Time to act | House Republicans representing farm states want the Biden administration to stand fast on enforcing trade agreements with Mexico, Bloomberg Government writes. Meanwhile, Bloomberg Law writes seasonal guest-worker visa programs discriminate against migrant women, using biased recruitment and hiring practices that funnel them into lower-paying and less desirable work, according to a complaint lodged against the U.S under its trilateral treaty with Canada and Mexico.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish Balance of Power, a daily briefing on the latest in global politics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.