According to ChemOrbis, many players in China’s polyolefins market are currently away from their desks due to ChinaPlas Fair that takes place on May 20-23. Demand is reported to be depressed for the most part which resulted in some discounts for PP from both import and domestic sellers.

Buyers are reported to be unwilling to replenish their inventories citing the current softening trend. With no supply concerns on the agenda owing to new coal based PP capacities in the country, sellers in China are mulling over boosting their export activities to Southeast Asia nowadays.

A Xiamen based trader stated, “Demand is very weak as domestic homo PP prices are on a downwards trend. We are not eliminating the possibility of offering to the Southeast Asian market under these circumstances. Many traders have already started to eye Vietnam as a destination.” On a weekly basis, domestic homo-PP raffia prices on an ex-warehouse China basis were down around CNY100-450/ton ($16-65/ton).

Traders in Shanghai and Zhejiang, meanwhile, predicted that PP copolymer prices will see some downwards adjustments soon too.

Softening seen in the Chinese market and reports of re-export offers of PP out of China pushed down import PP offers in Southeast Asia too this week. A trader commented, “We are bringing some quantities of coal based PP from China. Some players have already tested the material, but in general buyers are reluctant about purchasing this product especially since the price is not so far from conventional PP. As for market conditions demand is currently weak and many traders feel pressure to reduce their offers.”

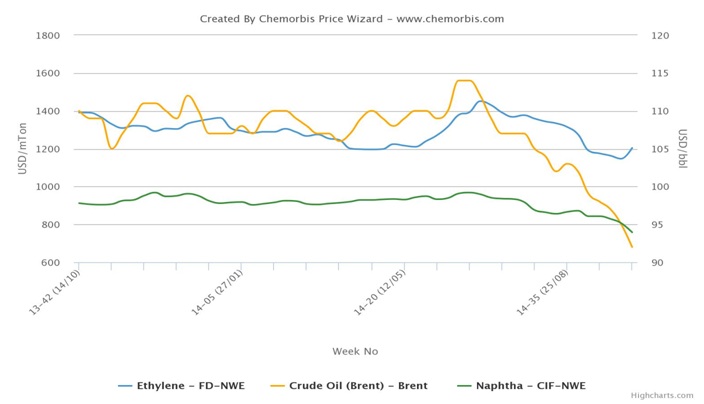

Upstream costs are not providing support for the market as well, according to ChemOrbis. Spot propylene prices lost $10/ton on FOB South Korea basis week over week. Spot naphtha costs softened around $20/ton on CFR Japan basis in the same period.