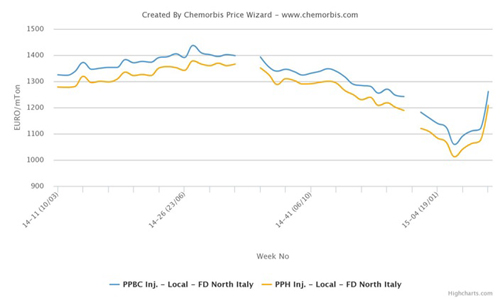

Oil prices gained on Thursday as data raised hopes of an economic turnaround and disruptions from OPEC member Nigeria stirred supply concerns.

The reading on the Philadelphia Federal Reserve business activity index was the highest since September 2008 while the Conference Board’s forward-looking measure of the U.S. economy posted its biggest increase in five years in May.

The reports helped lift U.S. crude by 34 cents to settle at $71.37 a barrel. London Brent crude gained 21 cents to settle at $71.06 a barrel.

The number of U.S. workers filing new claims for jobless benefits rose last week, but the number of people staying on the benefits rolls fell for the first time since January, data showed on Thursday.

“I think that the Philly Fed report which showed manufacturing contracting at the lowest rate in nine months and … the first drop in 21 weeks (in continuing job benefit claims) helped turn the market around,” said Gene McGillian, analyst for Tradition Energy in Stamford, Connecticut.

Oil prices have nearly doubled since February on signs of a potential economic recovery, which have sparked expectations for a rebound in fuel demand.

The World Bank on Thursday raised its forecast for 2009 gross domestic product growth in No. 2 oil consumer China to 7.2 percent, up from the 6.5 percent it projected in March. The economic data also helped lift U.S. stocks. .N

Oil prices also found support after Royal Dutch Shell (RDSa.L) confirmed some oil production had been halted following an attack on one of its pipelines on Wednesday in Bayelsa state in Nigeria.

“The market seemed to get a boost from fresh attacks in Nigeria,” said Tradition’s McGillian. “It looks like hostilities are increasing and the market is concerned about supplies from there.”

Security experts say guerrilla-style attacks on exposed oil infrastructure in the oil exporting country’s Niger Delta may spread in the coming weeks although militants are divided.

The economic crisis sent crude oil prices off record highs near $150 a barrel struck last July as consumption dropped.

The rise in oil prices in recent months has raised concerns that an increase in fuel costs could hurt any recovery in the global economy.

OPEC President Jose Botelho de Vasconcelos from Angola said a price between $70 and $75 a barrel was good for both consumers and producer.

“The (OPEC) goals are being met and I think that if by the end of the year prices remain at the $70 to $75 level that will be positive for the economy,” he told Reuters.

Source: news.chemnet.com