Turkey’s main import suppliers saw some changes for homo PP and HDPE in 2013 when compared to the previous years, according to ChemOrbis Import Statistics. Major suppliers in these two markets, who were subject to custom duties, saw their market shares ease somewhat while duty-free origins gained market share. This can be attributed to the fact that Turkey started to apply higher customs duties for all developing nations as of January 1, 2013, much before the EU’s reformed tariff scheme was put into effect in 2014.

In the homo PP market, overall imports showed a yearly increase of around 8% at more than 1,300,000 tons, according to ChemOrbis Import Statistics provided by TurkStat. This figure for homo PP includes the random copolymer imports made to Turkey in 2013 because the customs authority in Turkey started to recognize PP copolymers containing less than 5% ethylene as homo PP as per the existing definition of the customs tariff, which is also valid in the EU. The 58% slump in copolymer imports on a year over year basis is due to the same decision.

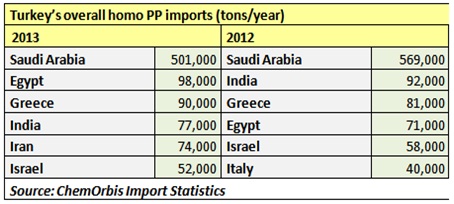

When looking at the top six suppliers to Turkey for homo PP, Saudi Arabia maintained its place at the top of the list in 2013 with a market share more than five times bigger than the second largest supplier. In other words, Saudi Arabia continued to dominate Turkey’s overall homo PP market with an approximate market share of 40%. However, imports from this country shed 12% year over year. The similar loss of market share was also valid for India, which moved down to the fourth place in 2013 from second place in 2012. A decrease of 19% was seen in homo PP imports from India on a year over year basis. The decision to raise the customs duties from 3% to 6.5% for these origins as of January 1, 2013 is in large part blamed for the decrease in imports.

Duty-free cargoes, on the other hand, gained a competitive edge in the homo PP market. Imports from Egypt jumped up by 36% on a yearly basis and this origin became the second largest supplier to Turkey for homo PP. Greece maintained its third place but they also exported more homo PP in 2013 to Turkey as statistics show a yearly increase of 11%.

Iran, meanwhile, displayed the most noticeable hike as homo PP imports from this country were 2.5 times higher in 2013, although Iran was not even in the top ten suppliers of Turkey in 2012. This was mostly because of the sanctions applied on Iran for the most part of last year, which pushed Iranian sellers to shift their allocations to the nearby Turkish market despite their relatively small PP capacities. Along with this jump, Iran even outpaced Israel, which is one of the major, traditional suppliers of Turkey. Israel, meanwhile, made 10% fewer exports to Turkey on a yearly basis, even though PP random copolymer cargoes were added to the 2013 figure. A trader blamed the production problems at the Israeli producer for its declining market share in Turkey.

In the HDPE market, the overall volume of imports stood almost at the same level as 2012 in 2013 at 654,000 tons. Saudi Arabia and Iran continued to be the first and second largest suppliers to Turkey respectively last year. However, their sales were down by 20-22% on a yearly basis. Imports from South Korea, meanwhile, skyrocketed last year due to the implementation of the free trade agreement on May 1, 2013. This year, South Korea is expected to have a larger market share as this origin entered Turkey with zero duty only during 8 months of 2013. Despite the relatively small window at which these cargoes were able to take advantage of no customs duties, South Korea almost caught the total imports made from India and Thailand during 2012.

According to ChemOrbis, another duty-free origin, Hungary, made a noteworthy jump as well since imports from this country doubled on a year over year basis, becoming the fourth largest supplier of Turkey. Imports from the US increased by more than double, at the same time. This is also attributable to the fact that Turkish pipe converters preferred to import this origin for PE 100 at competitive prices with a re-export license.