Data reported this month by the Society of Plastics Industry shows the importance of focus and specialization in the plastics business. There

Data reported this month by the Society of Plastics Industry shows the importance of focus and specialization in the plastics business. There

are 192,132 fewer employees in the plastics industry since 2005, a 22% decrease. The number of establishments has also declined by 8%.

Part of the problem-the economy. In 2008-2009, we saw the worst economic conditions since the 1930s. Some of it was movement of manufacturing to Asia.

But don’t blame the medical market. Demand for contract manufactured medical products is advancing 5% to 10% a year. The gross domestic product in the United States, while better than it was two to three years ago, is still only advancing at annual rates in the 1-3% range.

But there has been some attrition among medical contract manufacturers who perform plastics processing.

The bar is rising

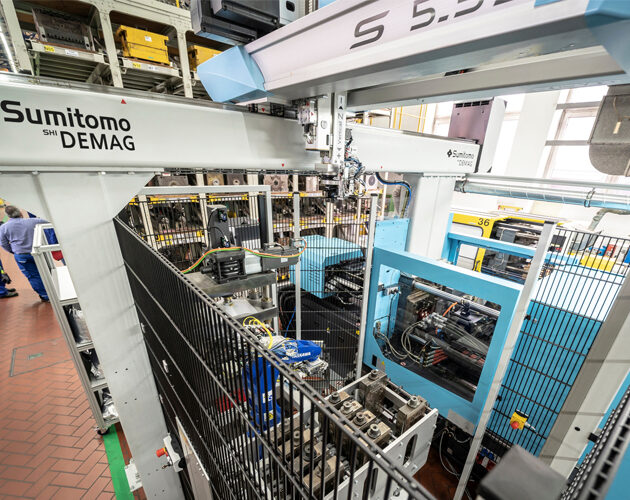

Many plastics processors don’t have the wherewithal to compete given the increasingly stringent requirements. “Because of the regulatory environment that has significantly increased in the last three to five years, there are fewer companies able to sustain themselves in the contract manufacturing business,” comments George W. Blank, chairman of Vention Medical (South Plainfield, NJ). “The overlay of the very stringent regulatory environment has made OEMs a lot more cautious. There is a lot more due diligence about where they are going to outsource. It’s not just about lowering costs. There is also a risk aversion.”

At the same time, there is a growing tendency for major medical original equipment manufacturers to look for outsourcing partners. “They may have seven new products they want to develop, but only have resources to develop five. That’s where contract manufacturers fit in,” adds Blank. “It’s much more balance sheet effective to have partners on the outside who have capacity than it is to expand.”

Vention has responded to the trend by adding design engineers and developing pilot cleanroom manufacturing for customers in Marlborough, MA

International reach

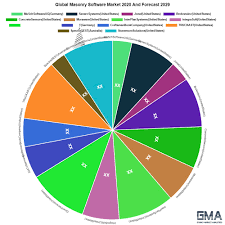

Medical device OEMs want design and manufacturing partners with depth, international reach, expertise, top-notch compliance programs, broad capabilities, 24/7 commitment, and best-in-class quality programs. They don’t care if you are the best injection molder in the entire United States. They want you to provide the services they need whether its plastics, metals, liquid silicone rubber, or some other processed material. That’s why you see companies such as MedPlast developing blow molding capability. Phillips Plastics, now owned by Kohlberg & Co., is an important powder injection and LSR molder.

Those requirements demand scale and a whole different approach to the business.

We’re not talking about shoot-and-ship injection molding of the 1970s and 1980s. Those companies aren’t players in this business. The best companies are acquisition candidates or launching pads for much-bigger platforms.

The trend is being fueled by the entrance of large private investment funds in the business. These companies are interested in pumping hundreds of millions of dollars into the contract manufacturing business, but they demand top-tier management talent and performance.

The confluence of these trends is transforming involvement of the plastic processing industry in the medical contract manufacturing business.

It’s a great trend. It secures a critical design and manufacturing base in North America.

Source : www.plasticstoday.com