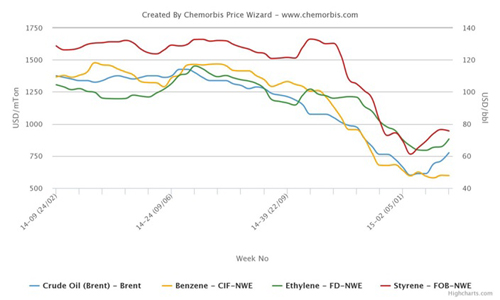

Initial Purchasing Managers’ Indices released yesterday for China, the Eurozone and the US, showed disappointing results for the month of April, following hopes, at least for China and the US, that the economies would strengthen as per the pricing service of ChemOrbis. Final figures are expected next week, but the news is not surprising to players in the plastics sector who have been watching prices fall over the month.

On Tuesday, HSBC, along with the information services provider, Markit, reported that manufacturing activity in China slowed in April, showing signs of weakness in the world’s second largest economy.The preliminary Purchasing Managers’ Index (PMI) figure released by the companies was lower at 50.5 for April, down from 51.6 in March. While the figure remained above 50, the demarcation line between expansion and contraction, the deceleration was disappointing. The bank blamed a slowdown in export orders during the month on the back of sluggish foreign demand for the deceleration.

The news is expected to spur the Chinese government to take action after weak economic growth was also recorded in the first quarter. China’s growth rate came to just 7.7% for the first quarter of 2013, below market expectations and below the overall growth rate for the year 2012, which came in at 7.8%, the slowest in 13 years. Market watchers had hoped for a better performance in the first quarter of 2013 after seeing a slight pick-up to 7.9% in the last three months of 2012.

Markit had similarly bad news for manufacturing in April in the US. The company’s initial PMI for the US fell to 52 in April from 54.6 in March, which was the slowest reading since October 2012. The company said manufacturing grew in April at its most sluggish pace in six months, showing the economy was losing momentum in the second quarter.

Lower domestic demand in the US was blamed for the result, as export orders actually rose, but concerns about tax increases and reduced government spending kept businesses and individuals hesitant about spending. Market watchers said the news was disappointing as it had appeared the economy was picking up after Gross Domestic Product (GDP) expanded at 3% in the first quarter, an improvement on the rate seen at the end of 2012.

The news from the Eurozone was equally disappointing. According to Markit’s initial PMI for the Eurozone, the index fell to 46.5 in April from 46.8 in March. This was the 21st time the PMI contracted on a monthly basis. The Eurozone PMI Composite Output Index was steady at 46.5 for April, but any index figure below 50 indicates that manufacturing is contracting.

“Although the (composite) PMI was unchanged in April, the survey is signaling a worrying weakness in the economy at the start of the second quarter, with signs that the downturn is more likely to intensify further in coming months rather than ease,” said Markit Chief Economist Chris Williamson.

Surprisingly, Germany’s private sector was also reported to be shrinking for the first time since last November. Both the country’s services and manufacturing PMI figures came in below 50, which show a contraction. The service PMI was down to 49.2 in April from 50.9 in March and manufacturing was down to 47.9 from 49. The composite PMI broke below the threshold of 50 to 48.8 in April, down from 50.6 in March.

According to ChemOrbis, a senior economist with Markit, Tim Moore was quoted as saying, “The data suggests the German economy could shrink this quarter. Weaker demand was attributed to subdued business confidence across the euro area, with clients cutting spending amid concerns about the economic outlook for southern Europe. In the manufacturing sector, there were also reports that destocking efforts had led to reduced production requirements.”