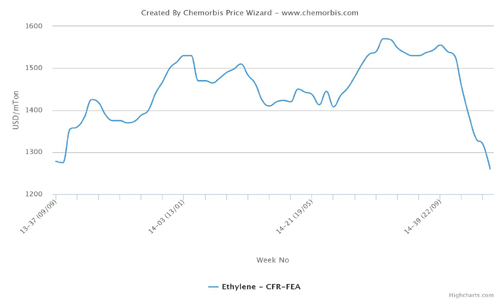

In Egypt, April Middle Eastern PP and PE prices have started to be announced to the country with decreases in line with earlier expectancies given the globally bearish trend for these products as well as the current weak economic conditions inside the country and the ongoing political issues as per the pricing service of ChemOrbis.

A Saudi Arabian producer approached the market with $50-100/ton decreases for PE and $60-70/ton drops for PP. However, despite these decreases, players are still not happy with the new lower prices since the difficulties in obtaining US dollars and the high parity make the import offers unattractive.

A buyer, who received the new April offers from the Middle Eastern supplier, commented, “We were expecting larger decreases from the producer as they have announced better price levels in their own local market. Plus, here in Egypt, we continue to suffer from problems stemming from obtaining US dollars, which continues to hamper our purchasing power. Under normal circumstances, these new lower offer levels would be acceptable but the current economic conditions do not give us much room to move.”

Many in the market continue to complain about the high dollar parity and lack of dollar availability. They highlight the fact that they need to turn to the black market to obtain dollars, but then have to pay higher rates than the official exchange rate revealed by the Egyptian banks. According to players, they have to pay 7.5 EGP for 1 USD if they want to acquire dollars although the banks’ official rates are at 6.8 EGP for 1 USD.

Most players complain that this situation wipes out the amount gained from the price decreases announced in the import market according to ChemOrbis. The new import offers at the higher parity would also come to a level above locally held materials after adding an estimated $30/ton in clearing and handling charges.