When it comes to Jabil Circuit Inc., you can now take the “E” out of Electronic Manufacturing Services (EMS)–the tag line used to identify the third-party contract manufacturers that mushroomed to handle outsourced computer and other electronics manufacturing in the 1990s. The reason is the $665 million acquisition announced week of Nypro, one of the largest contract plastics injection molders in the world.

“Use Global Manufacturing Services to describe us now,” says Timothy L. Main, president and CEO of Jabil, which is based in St. Petersburg, FL. Nypro pushes Jabil three to four years ahead in its plan to boost diversified manufacturing capabilities, particularly in healthcare and packaging. And Nypro appealed, he says, because of its 40-year history, its credibility, its people, and its capabilities. The credibility factor is particularly important in the medical field.

Jabil’s largest customers currently include Agilent Technologies, Apple Inc., Cisco Systems, Inc., Ericsson, EchoStar, General Electric, Hewlett-Packard, IBM, NetApp and Research in Motion. Its primary competitors are behemoths: Benchmark Electronics, Celestica, Flextronics, and Hon-Hai Precision Industry.Jabil had net revenues of $17.2 billion in fiscal year 2012 and net income attributable of $394.7 million. In fiscal year 2012, Jabil’s five largest customers accounted for 48% of net revenue and 54 customers accounted for 90% of our net revenue.

The other major factor behind the acquisition besides diversification is scale. Courtney Ryan, global business manager for Jabil, says he met with major customers, and they wanted suppliers that can provide turnkey solutions on a global basis. Nypro felt it couldn’t obtain the capital to grow on its own to provide that scale because of its employee ownership.

Jabil Circuit is now the number one contract manufacturer in the medical field.The EMS industry has been scrambling to re-invent itself since mid-2001when the technology sector crashed.Traditionally, EMS companies acquired manufacturing capacity from customers to grow and pick up new customers. In recent years, acquisition strategy has focused on acquiring smaller manufacturers operating in key markets, such as healthcare, defense, aerospace and industrial, particularly if they offer materials technology and design services.

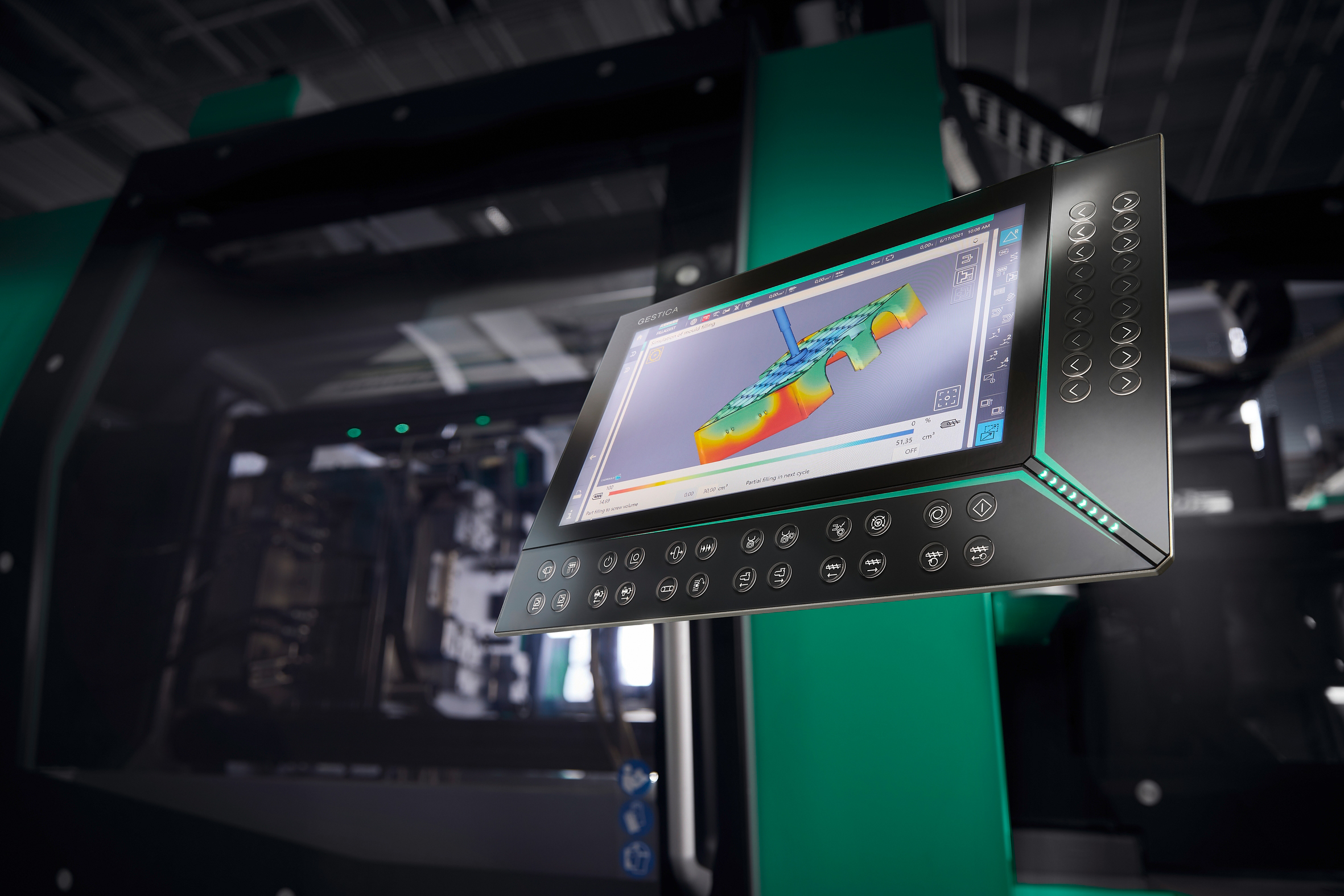

The primary goal of Jabil’s acquisition strategy has been to complement current capabilities and diversify business.Jabil acquired a company called Taiwan Green Point in 2007 to develop a presence in plastics molding. It specializes in making plastics housings for mobile phones and other electronic devices. That actually represents a major overlap with Nypro, which has consumer electronics injection molding plants in many of the same cities in China as does Green Point. It’s also the business where Nypro has been struggling. It’s possible that Nypro’s consumer electronics business is not even profitable, in part because of the loss of a major customer recently.

But consumer electronics capabilities clearly isn’t what interested Jabil. What is of interest is packaging and healthcare. Both are very engineering and design intensive, have much more loyal customer relationships than is the case for electronics, and have long product cycles compared to electronics.

In fact Jabil will become the first player in the EMS sector to have a footprint in rigid packaging, which represents 23% of Nypro’s $1.2 billion in sales, or about $176 million. Packaging is the fastest growing market sector at Nypro. Consumer electronics, with a 32% share, is dropping. Healthcare is growing, and currently has a 45% share of Nypro revenues.

Jabil sounds like an Arabian name, but it’s not. It’s an amalgamation of its founder’s first names. William E. Morean and James Golden founded the company in 1966 in Detroit.

Source: http://www.plasticstoday.com/blogs/jabilnypro-new-global-no-one-healthcare-manufacturing0208201305