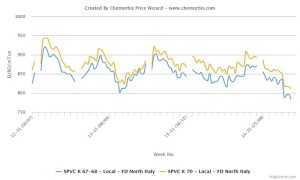

In Italy, the PVC market remains on a softening note for a second consecutive month as expected while prices are suggesting relatively smaller decreases compared to last month. Following the initial December adjustments, spot PVC prices continue to hover at around the lowest levels since August 2012, as per the pricing service of ChemOrbis.

Lower upstream costs were cited as the main reason behind the prevailing softer trend for PVC. The monthly ethylene contracts settled down €50/ton from November at €1010/ton FD NWE towards the end of last week, weighed down by plunging energy markets. In addition, demand remains weak towards the end of the year while no production outages or supply concerns were reported for PVC, according to ChemOrbis.

A West European PVC producer expressed their December sell ideas with decreases of €15-20/ton after settling their November gentlemen’s agreements with discounts of €40/ton. A producer source said, “We are targeting to recover our margins so we are unwilling to concede to half of the ethylene contract drop.” A distributor expressed his December sell ideas for Central European PVC €20-25/ton below November. Another distributor started giving initial PVC offers with decreases of €25/ton for December. The distributor expects buyers to return to the market this week since December will be a short month in terms of working days.

A compounder reported receiving West European PVC offers with decreases of €20-25/ton for December after settling his November gentlemen’s agreements with discounts of €40/ton. According to the buyer, the downward trend has already been confirmed for this month while PVC prices may stabilize in January. A pipe producer reported that he expects his West European PVC supplier to concede to discounts of at least €20-25/ton for their December gentlemen’s agreements given weak demand amidst short working days.