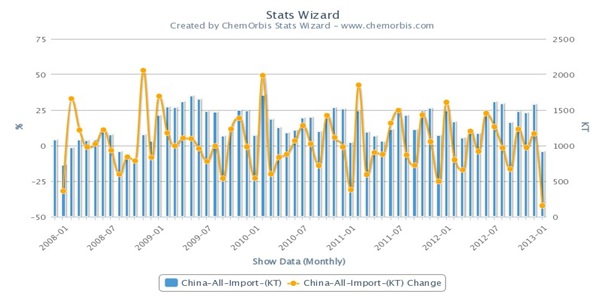

PE players in Italy and Egypt report tight LDPE film availability, which helped push up prices as per the pricing service of ChemOrbis. Offer levels for this product saw increases during the month of June when compared with late May levels. In Italy, LDPE film prices indicate €50-70/ton hikes while in Egypt, LDPE film prices move up by EGP400-500/ton ($57-71/ton) in the course of June when compared with late May levels.

A distributor in Italy said, “We sold our June PE cargoes at our initial levels without any discounts from the beginning of the month. Looking into July, we anticipate further increases given firm feedstock costs and tight availability.”

Another distributor, who revised their LDPE film prices upward by €20/ton with respect to their early June levels, commented, “overall supply levels are very tight, especially for LDPE and LLDPE film. Therefore, we expect to see higher prices in July.”

A buyer who received June offers with €40/ton increases from May added that July delivery materials are €10/ton higher from the initial June offers they received. “We have made some purchases in sufficient amounts and therefore we are comfortably covered until September. Considering our adequate stock levels, we do not want to commit to fresh cargoes until July. We saw good end product demand from the packaging sector during May but now our end business is returning to normal levels. Regarding availability, the market is tight for LDPE and LLDPE film. Therefore, we hear possible increase talks for July,” he added.

Another converter who received €50-60/ton hikes for June reported, “We have not made any fresh purchases since we are holding some stocks. Nevertheless, we will have to purchase in July, although if prices rise on tight availability we will not be able to make purchases in large volumes. Our South European supplier’s LDPE stocks started dwindling at the end of May. We received a different LDPE grade than the one we ordered as our supplier did not have any availability for that specific grade.”

A different packaging producer said, “We paid €40-50/ton hikes for June but the amount we bought was small since our end product orders have been diminishing. Meanwhile, sellers started refusing orders from buyers and this situation makes us think that they are planning hikes for July. Yet, we think that the increase amounts are likely to be limited in July.”

Meanwhile, in Egypt, players report tightness for most materials as well as LDPE film, prices for which recorded EGP400-500/ton ($57-71/ton) increases during June. A converter in Cairo said, “Supply levels are very limited and this situation has led to an increase in prices. On the other hand, buyers have been very cautious when making fresh purchases recently due to the approaching June 30 protests in the country. Plus, liquidity issues persist amidst the higher dollar parity. Therefore, we are running our plant at around 50-60% capacity for the time being.”

Another converter said, “Some distributors, who want to take advantage of the tight supply situation, are offering at very high levels. Meanwhile, most June shipment cargoes are still tied up at the ports since players cannot clear them because banks are not meeting their payment conditions. This situation also adds to the restricted availability.”

According to ChemOrbis, a different converter said, “Locally held Middle Eastern cargoes are very limited in the market and most distributors are holding onto their stocks. To make matters worse, the local HDPE producer SIDPEC encountered a power failure during the previous week and they shut their plant the following weekend for maintenance. This situation, although now resolved, hindered the producer’s deliveries for a short time and worsened the supply issues. Meanwhile, we need to purchase some materials and therefore we have no option but to accept the current levels. Distributors are not willing to fully supply our requested quantities.”