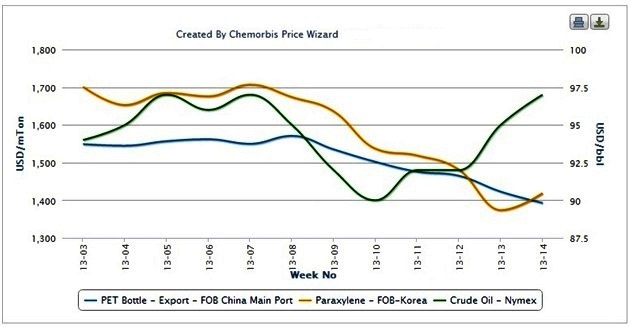

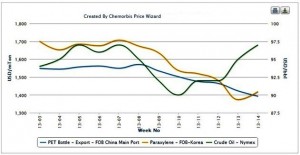

Asian PET prices continued to soften this week, although players began to express hope that the market was nearing the bottom as PET feedstock prices started to change direction following steep declines in March as per the pricing service of ChemOrbis.

The first week of April has brought renewed upward movement in PET feedstock prices following massive March declines that saw spot prices for PX plunge $210/ton while PTA prices shed $110/ton and MEG prices lost $60/ton, all on a CFR Northeast Asia basis. During the first week of April, which will be a short week in Asia owing to the Qing Ming holidays in China, spot prices have risen $65/ton for PX, $25/ton for PTA and $35/ton for MEG. In China’s domestic market, a PET producer reported that Sinopec announced its local contract prices for April with rollovers for PTA and MEG and CNY550/ton ($89/ton) decreases from March. The producer had settled its March contracts with triple digit decreases on dollar basis for all three products.

This week’s reversal in the downward trend for PET feedstocks has not yet lead to any up-tick in PET prices, although players are beginning to speculate the current downward trend, which has been since the end of February, may bottom out soon. A source at a Chinese producer commented, “We lowered our local prices by CNY100-200/ton ($16-32/ton) this week, but we believe that prices will not see any further reductions. Our sales are starting to pick up following the recent reversal in upstream costs.” A distributor based in Shanghai added, “We maintained our prices this week and are willing to negotiate with buyers placing firm bids. We think that the market will stabilize after the holidays given the recent upturn in feedstock costs. In addition, the upcoming high season for many PET applications is starting to tempt buyers back to the market.”

According to ChemOrbis, a source at another Chinese PET producer reported, “We are not feeling any stock pressure these days and are seeing normal demand for our end products. We are closely following developments in upstream markets and we believe that PET prices will regain some lost ground after the holidays.” Meanwhile, a source from a separate producer stated, “We concluded some deals with $10-20/ton discounts this week, but we believe that export prices will stabilize next week owing to the recent upward movement in upstream costs.”