Gandhinagar, India — India’s massive goods and service tax reform program, hailed as a way to unify the country’s internal markets and tax system, is proving to be an adjustment for the plastics industry.

Most industry executives interviewed at the recent Plastindia show in Gandhinagar feel the new GST program, started in mid-2017, will be a positive in the long run, streamlining logistics and making it easier to invest in India.

But there have been growing pains as the industry’s trade associations have pushed for what they see as better classification and lower tax rates for plastics goods and equipment.

The plastics industry had objected that some of its goods were placed in 28 and 18 percent tax brackets. It said, for example, that taxes on some plastics used in packaging were higher than taxes on glass, wood and tin in packaging, which were placed in a 12 percent bracket.

The head of the National Advisory Board of the Plastindia Foundation voiced concerns in his address at the show’s opening ceremony Feb. 7, urging further revisions by government.

“The GST council [should] consider a low tax rate for the sector, as an 18 percent tax is too high,” M.P. Taparia said.

Plastindia Foundation President K.K. Seksaria said the industry has met with government officials as they have rolled out the GST and has achieved some successes. But he also said more work needs to be done.

“The stakeholders should aggressively seek it to lower down to 12 percent,” Seksaria said.

Still, he and other business leaders said they felt that the GST system over time would help the country’s development and boost the country’s low per-person consumption of plastic products.

“Earlier, every state in India was a different market but now the whole country is unified as a common market,” Seksaria said.

The GST is levied on goods and services and removes 14 taxes at various central and state levels in one shot.

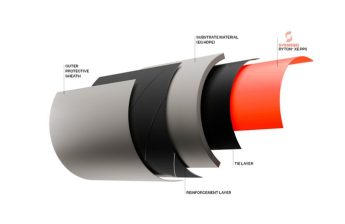

“The complexity of multiple layers of taxes at various levels and dealing with sales and excise authorities are over with the introduction of the GST,” said Sunil Jain, president of extrusion machinery supplier Rajoo Engineers Ltd.

A January study from consultancy Wood Mackenzie predicted the GST would lead to more investment in plastics manufacturing India.

“The impact of India’s goods and service tax will be more visible in 2018 as the initial ‘teething problems’ are in the rearview mirror,” the firm said. “Inland logistics is likely to be more efficient with the implementation of the GST, which will lead to more expansions and new investments in the plastics manufacturing facilities.

Still, it’s a work in progress.

“The GST is good for the country but the implementation is patchy, [with a] lack of clarity on GST norms and their interpretation creating confusion,” said Vikram Bhadauria, director of Delhi-based Alok Masterbatches Ltd.

Executives said it’s sometimes hard to understand how products have been assigned to various tax brackets, with some plastics equipment posted to the 28 percent luxury tax bracket.

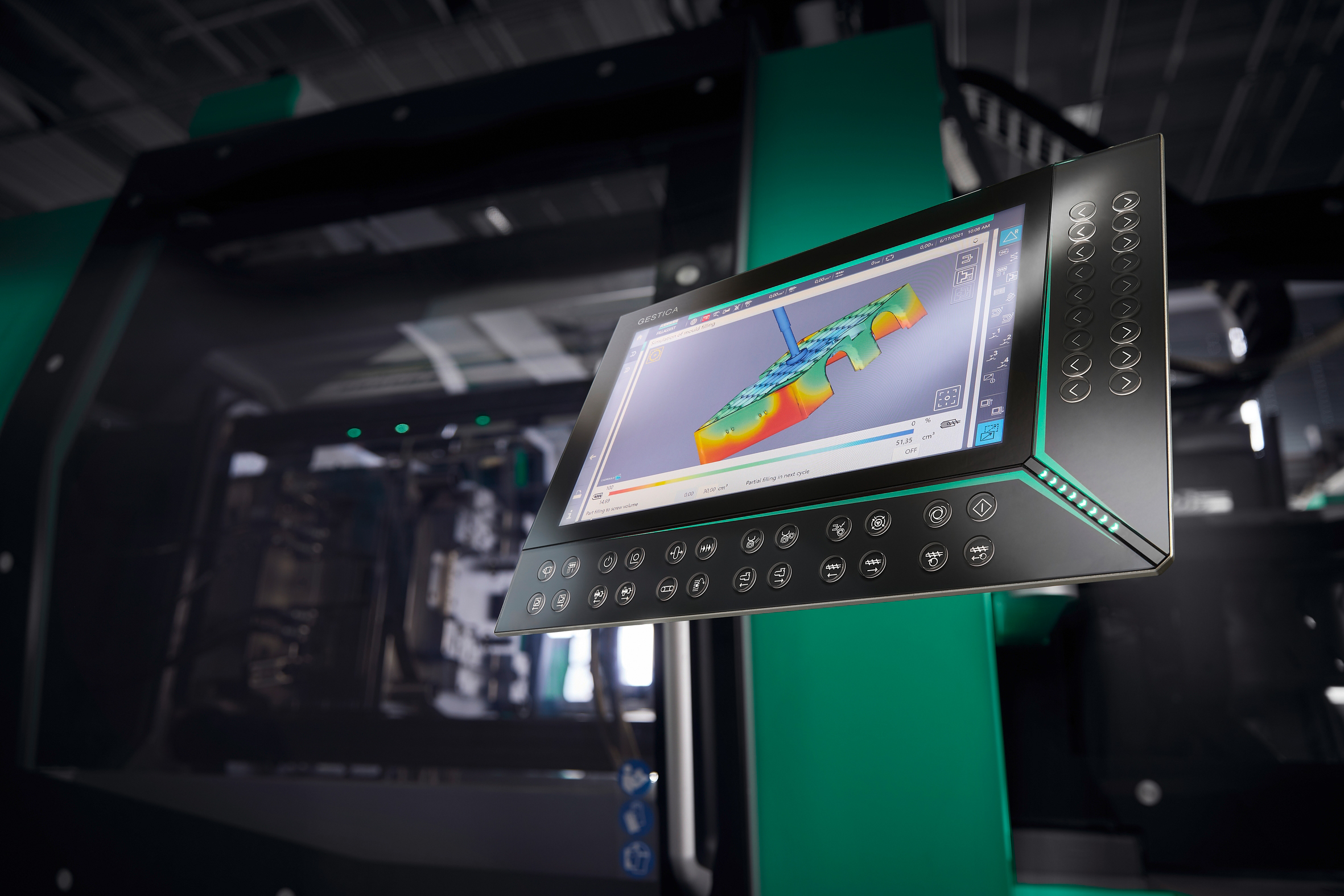

P. Kailas, managing director of Toshiba Machine (Chennai) Pvt. Ltd., the India subsidiary of the Japanese injection machine maker, said that “injection molding machinery is bracketed under the standardized 18 percent slab but products like industrial chillers are represented as a luxury item and put into the higher slab of 28 percent and has not [been] lowered as yet.”

The industry argues that improper classification will hurt thousands of small and medium-sized plastics manufacturers and also raise prices of plastics products used by the country’s poor.

The Mumbai-based Plastindia Foundation believes that small firms are most likely to be impacted by the higher GST rates. It said that over 95 percent of the 50,000 companies in India’s plastic sector are SMEs.

Government officials have said increasing GST compliance and revenue collection could in time lead to lowering rates. But with the government’s top economist recently saying that it could take a decade for the GST process to settle down, that assurance may seem a bleak possibility to some.

Overall, business groups say GST will eventually bring more efficiencies with online filing of registrations, returns and refund applications. GST proponents say it will bring greater transparency and help curb tax evasion.

The head of the India factory of U.S. equipment maker Milacron Holdings Corp. sees positives.

“Change is good for all of us as the GST streamlined the buying and selling process,” said Managing Director Shirish V. Divgi. “We are also helping our clients and vendors [who were] puzzled initially in aligning with new system.”

Alok Masterbatch’s Bhadauria believes the issues can be sorted out soon: “I think it takes one more year to iron out and resolve all the glitches in implementing GST.”

Source : converternews