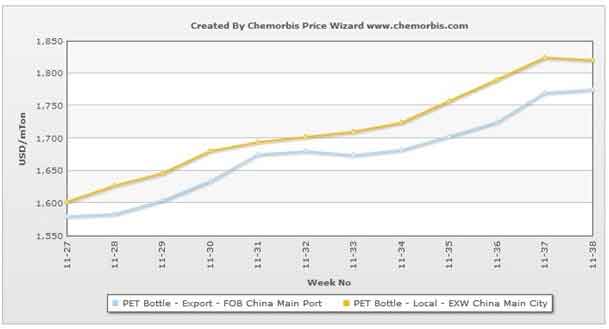

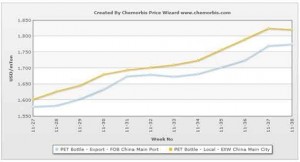

In Asia, PET prices have edged up over the past week, pushed up by higher upstream costs as per the pricing service of ChemOrbis. Spot MEG prices in the region climbed around $25-30/ton on the week due to firmer PTA futures and crude oil prices. Crude oil futures for August delivery on the NYMEX climbed around $3/barrel over the past week after hitting a 15-month high on July 10.

In China, domestic producers lifted their export PET prices by $10/ton week over week citing higher upstream costs. A source from a producer commented, “We think that prices will remain firm in the short term, especially after the PTA futures posted large increases in the previous week.” Another producer source added, “We may consider issuing further increases in the short term given our poor margins. We expect spot PTA and MEG costs to remain strong, supported by improved demand from the textile sector.”

Despite raising their export prices, a few sellers admitted seeing slower demand following their latest adjustments. A supplier said, “Buyers are taking a wait-and-see attitude towards higher prices. Supply levels seem to be rising as producers are generally running their plants at high rates while demand is losing speed.” Another seller also confirmed that buying interest was relatively weaker, adding, “We are open to negotiations for firm counter bids. However, we are unwilling to concede to large cuts given strong energy markets.”

In Southeast Asia, PET prices are stable to slightly firmer week over week while players are commenting that they expect to see stronger prices in the upcoming days in line with higher feedstock costs. A regional producer reported keeping their prices stable towards the end of last week. A producer source said, “We may consider issuing small hikes of $10-20/ton in the upcoming days in line with the recent upward movement of upstream markets. Demand is satisfactory in Southeast Asia as our contractual customers made some purchases despite the approaching Ramadan holiday. We are running our plants at full rates for now.”

A Far East Asian producer raised their export PET prices by $10-20/ton from last week, pointing to better demand in China besides firmer upstream costs. “We don’t expect prices to post major increases as large buyers have already secured some cargoes. We aim for modest hikes in line with the rise in upstream costs,” a source from the producer commented.

Meanwhile, buyers in the region are mostly covered for now as they had built some stocks ahead of the recent increases, according to ChemOrbis. A bottle manufacturer in Indonesia received both import and local PET offers with increases of $10-20/ton on the week. He commented, “Our stocks are sufficient until early August as we had already made some purchases two weeks ago when prices reached the bottom level.” A converter in Vietnam also reported receiving firmer PET prices, adding, “Our end product demand is good these days while we are covered until the end of August as we secured some cargoes when prices were lower.”