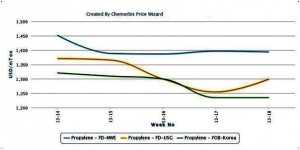

Spot propylene markets followed a steady to firmer trend over the week in major markets including Europe, Asia and the US as per the pricing service of ChemOrbis. The main driver behind the stronger path on a global scale was deemed as several supply constraints on planned or unexpected outages at regional crackers. Plus, crude oil prices in the US and Europe turned up over the week following the relentless losses they had registered in the previous week to see prices below the thresholds of $90/barrel and $100/barrel respectively.

Looking at the fragile energy markets, crude oil futures for June deliveries erased the previous losses and rebounded by $5/bbl on the NYMEX week over week, although they still remained $4/bbl below early April levels. ICE Brent crude oil futures regained around $3.51/bbl for June delivery cargos in the period, but similarly failed to catch early April levels and indicated a decrease of nearly $8/bbl.In tandem with the firming energy complex, spot naphtha markets showed some rebounds both in Europe and Asia over the course of the past week. Spot naphtha costs soared by almost $20-25/ton in a week on CIF NWE and CFR Japan basis. Nevertheless, these figures continued to represent decreases of $80/ton in Europe and $55/ton in Asia with respect to the beginning of April.

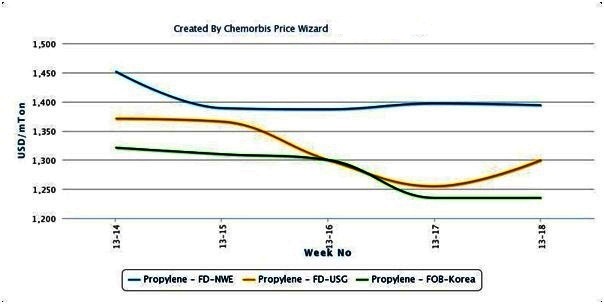

Spot propylene costs in Asia inched up by $10/ton on FOB South Korea basis on a weekly basis. The latest figures still indicated a $65/ton loss when compared to early April though. In Europe, the week ended on a bearish note in terms of May propylene contracts, which settled down €80/ton from April settlements. The lower contract was not surprising owing to steadily falling upstream costs for the most part of April. However, last week, spot propylene prices managed to hold steady on FD NWE basis, although they stood €10/ton below early April levels. In the US, polymer grade propylene offers moved up by 2 cents/lb ($44/ton) on DLVD USG basis week over week.

In addition to the contribution from the firmer upstream chain, the main supporter of steady to higher propylene markets was supply constraints that emerged. In Asia, Thailand’s PTT Chemical reportedly plans to bring their I4-1 cracker down during the first half of May within the context of a scheduled turnaround. Located in Map Ta Phut, the cracker is able to produce 250,000 tons/year of propylene.

In Europe, cracker operators had already lowered their production rates to counterbalance lethargic buying interest for some time now. On the top of that, Shell Nederland Chemie (SNC) declared force majeure on output from their cracker in Moerdijk, the Netherlands last week after the restart of the cracker was delayed. SNC currently has no capability to supply Shell Chemicals Europe (SCE) with cracker products such as ethylene, propylene, acetylene and crude c4. The company began a planned turnaround at the cracker, which has a propylene capacity of 500,000 tons/year, in early March and had expected to restart the facility at the end of April.

In the US, market sources reported unexpected outages in the past week according to ChemOrbis. PetroLogistics shut their PDH (propane dehydrogenation) unit in Houston as the site’s safety interlock system shut the plant down as of April 22. The unit normally produces 545,000 tons/year of propylene. The company reportedly planned to carry out four weeks of maintenance at the unit in October this year. Market sources stated that Citgo also faced some production outages at their FCC (fluid catalytic cracker) located in Corpus Christi, Texas.