Middle Eastern producers have been supplying rather limited PP and PE quotas to many global markets, including Turkey, Egypt, Vietnam as well as the Middle East and African markets as per ChemOrbis. Based on the ongoing limitation on the quota amounts and the firmer trend that has started to be seen in Asia and Europe, global players mostly anticipate firmer May levels from the Middle Eastern producers.

A source from a Middle Eastern producer, who offers to Turkey, noted that they are aiming for at least a $20/ton hike for May. “Netbacks to Turkey are still not sufficient and therefore, Middle Eastern producers are likely to minimize their allocations to Turkey if netbacks do not improve,” he further added.

A different Middle Eastern producer’s representative said, “We mostly sold out for April and we feel free from inventory pressure. Given the firmer trends seen in Asia and Europe, May prices are likely to record increases.”

Another Middle Eastern producer reported that their May quotas to Turkey will see some relief in May but added that their overall allocation will still be limited.

Another Middle Eastern source said that they were sold out for April. “We expect firmer PP prices for May given the firmer trend in Europe. However, PE prices might be rolled over. Regarding demand, we do not see any real change,” he further added.

In Saudi Arabia, a distributor remarked, “A Saudi Arabian producer resumed their deliveries to the local market although it is still in limited amounts. If demand starts improving and supply issues persist, we might see higher prices for May.”

A household products manufacturer operating in Lebanon commented, “We concluded some deals after being able to obtain small discounts from the Middle Eastern producers’ initial April prices. However, overall supplies are limited in Lebanon as a major Middle Eastern producer’s HDPE blow molding, HDPE injection and LDPE film availability is very tight. Regarding demand, the Lebanese market is still weak but we anticipate some improvements in the next month.”

A trader in the United Arab Emirates said, “In general, supplies are balanced with demand except for Middle Eastern LLDPE film, which is tight. Most suppliers appear to be sold out and demand generally performs well. Nowadays, May expectations have started to surface in the market on a firmer note.”

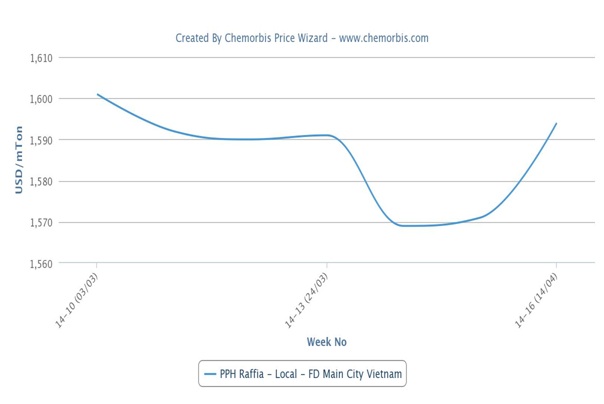

In Vietnam, two Middle Eastern producers revealed May prices with increases. One producer issued $60-70/ton hikes on their LLDPE film prices, pointing to their limited availability, while the other one lifted their LLDPE film price by $60/ton and HDPE by $40/ton for the next month.

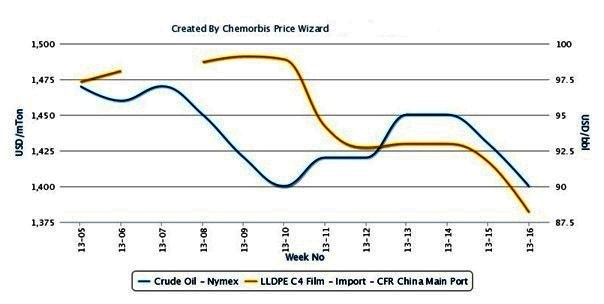

According to ChemOrbis, in China, a Middle Eastern producer concluded a late April deal for LLDPE with an increase of $40-50/ton from their initial April prices. The producer, however, sold out their PP quotas at the same level as their initial April prices. A source from the producer commented, “Overall demand is still not picking up significantly but we anticipate prices to fluctuate at around the high ends of the ranges as the low ends have been disappearing. The downstream markets might need time to digest the increases due to still slow demand but limited supplies will definitely stop any decreases.”