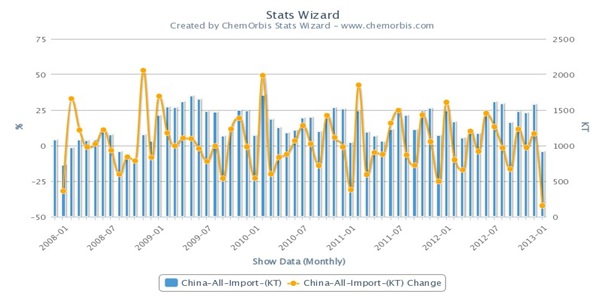

Moving into September, ethylene costs jumped on a global scale driven by production issues and strong upstream chain, as per the pricing service of ChemOrbis. Spot ethylene prices posted noticeable increases in major markets including Europe and Asia amidst unexpected cracker shutdowns while Hurricane Isaac reduced a noticeable percentage of ethylene availability and pushed prices higher in the US.

In a weekly comparison, energy prices gained further ground. NYMEX October crude settled up $1.85/barrel at $96.47/barrel on Friday, the last day of August, which indicated an increase of nearly 32 cents/barrel on the week. The total increase amount reached more than $7/barrel during August. ICE October Brent crude rose by $1.92/barrel to settle at $114.57/barrel at the end of last week, representing a weekly gain of 98 cents/barrel. The level brought the total increase to over $8/barrel from the beginning of August.

Firmer energy costs pushed naphtha costs up further during the past week. In Europe, spot naphtha prices gained $10/ton on CIF NWE basis, bringing the total increase to nearly $130/ton during last month. In Asia, although spot naphtha offers were steady on FOB South Korea basis on the week, they spiked by around $115/ton since the start of August.

In Europe, higher naphtha prices combined with tight ethylene supply due to recent cracker shutdowns at Borealis and Shell pushed spot ethylene offers up €65/ton on FD NWE basis from the previous week, as per ChemOrbis. Ethylene prices surged €145/ton during last month, which created an upwards pressure on September monomer settlements in the region. September ethylene contracts settled up €125/ton with the same terms, the second increase in a row.

According to the latest production news, Borealis maintained its force majeure on the output from its 620,000 tons/year cracker in Stenungsund, Sweden after shutting it unexpectedly on August 22. The company reportedly planned to resume operations by early this week. Shell Chemicals reportedly solved problems with its compressors at its cracker in Moerdijk, the Netherlands that occurred early last week and resumed normal operations.

In Asia, spot ethylene prices jumped $95/ton on CFR Northeast Asia basis week over week, which was attributed to strong demand for September cargoes amidst availability constraints in the region. The most recent values represent a massive hike of $220/ton during past month.

Typhoon Tembin caused production disruptions in South Korea and Japan, exacerbating the existing supply concerns on planned shutdowns in China and Taiwan. South Korean YNCC raised the operating rates to 100% at its three crackers late last week after cutting them due to the typhoon. The crackers have a combined ethylene capacity of nearly 1.9 million tons/year. Japanese Mitsui Chemicals restarted its Chiba cracker by the middle of last week after shutting it due to the same reason on August 21. The cracker normally produces 600,000 tons/year of ethylene.

As for scheduled shutdowns, Sinopec Sabic Tianjin Petrochemical Co. shut its 1 million tons/year cracker in China in mid-August for a 45-day maintenance. Also, Formosa Petrochemical will keep its 1.03 million tons/year No.2 cracker in Taiwan shut for a government inspection. The company is reportedly expected to resume normal operations by September 15.

In the US, Hurricane Isaac drove large increases in the ethylene market as it cut around 18% of ethylene production in Louisiana since the beginning of last week, according to sources in the country. Spot ethylene values rose by 3.5 cents/lb ($77/ton) on FD USG basis week over week, with recent levels representing an increase of 12.75 cents/lb ($281/ton) during August, as per ChemOrbis.

Given the hurricane, Williams shut its 612,000 tons/year cracker while Dow Chemical brought its 598,000 tons/year cracker down. In addition, Shell Chemicals lowered the operating rates of its two crackers with a combined capacity of 1.36 million tons/year.

https://www.plasticsinfomart.com/wp-content/uploads/2012/08/555608_10150986812971862_612746501_n.jpg