In Asia, spot olefin markets witnessed a new round of drops heading into the second half of April mainly driven by the bearish upstream chain as per the pricing service of ChemOrbis. Declining crude oil prices and spot naphtha costs exerted an extra downwards pressure on the sentiment and pushed more buyers out of the market last week. These drops in olefin prices came in spite of the attempts by several cracker operators to balance supply and demand by cutting their production rates.

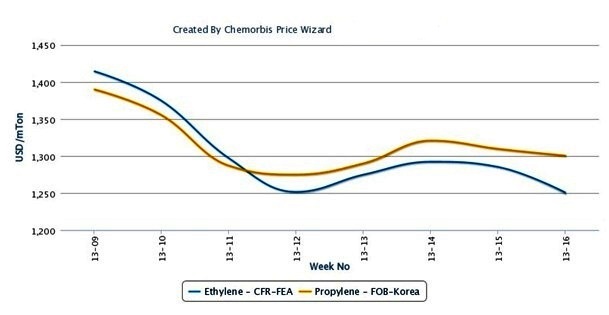

In the ethylene market, spot offers decreased $45/ton on CFR Northeast Asia basis week over week while they indicated a $40/ton fall with respect to the beginning of April. Regarding propylene, spot prices posted a decrease of $65/ton over the week. Plus, they represented a similar loss from the start of April. Spot ethylene and propylene costs had followed a bearish trend for the most part of March. They had rebounded some in late March after almost reaching par with each other by the middle of last month.

On the NYMEX, crude oil futures for May deliveries lost nearly $1.5/barrel during the past week, most of which occurred in the last two days of the week. Also, ICE Brent crude futures for May deliveries dropped around $1/barrel in the same period triggered by the falls during the last three days of the week. Nonetheless, the decreases neared approximately $6/barrel in the US and $8/barrel in Europe when a comparison to early April was made.

Sizeable drops in the energy complex since early April pulled the naphtha market down further in Asia. Spot naphtha prices were down slightly more than $30/ton on CFR Japan basis with respect to the first week of the month, while they represented a larger fall of around $55/ton from April 1, 2013.

Indeed, some cracker operators tried to counterbalance weak olefins demand from the derivatives markets by reducing their production rates in the last couple of weeks. Taiwanese majors Formosa Petrochemicals and CPC Corp. were among the companies which lowered their operating rates to around 90-95% capacity in March-April citing their poor margins, industry sources reported earlier this month. However, bearish upstream markets made buying interest thinner and overshadowed these attempts, according to several market sources. Formosa runs three crackers in Mailiao which can produce 2.93 million tons/year of ethylene and 1.46 million tons/year of propylene in total. CPC Corp. operates two crackers namely, No.4 and No.5, located in Linyuan and Kaohsiung. These crackers produce 880,000 tons/year ethylene and 443,000 tons/year propylene in total.

Looking at recent supply news, Mitsubishi Chemical will reportedly shut their Mizushima cracker in Japan starting from the second half of May for a regular maintenance according to ChemOrbis. The cracker, which produces 495,000 tons/year of ethylene and 320,000 tons/year of propylene under normal circumstances, is scheduled to remain offline for 50 days. Plus, South Korean GS Caltex reportedly delayed the restart of their fluid catalytic cracker (FCC) in Yeosu to mid-April. The cracker was down given a technical problem in early April.