Western European commodity thermoplastic producers are striving to raise prices and restore profit margins to what they consider a more acceptable level. Their efforts are, however, being held back by converters’ unwillingness to buy any more material than they need for current production.

Converters, of course, are facing up to the combined effects of the economic downturn and intensifying price resistance from their own customers. The pricing situation for individual polymer classes varied widely in March. L/LDPE saw the biggest price gains, up €70-80/tonne, as a result of tightness in ethylene supply and growing concern about supply reliability in view of plant closures and production cutbacks. HDPE registered smaller gains with injection moulding grades under most pressure.

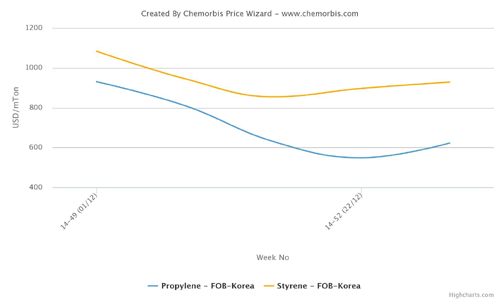

Polypropylene is the best performing polymer sector with improving sales and prices €30/tonne higher in March. Polystyrene producers also managed margin gains, while PVC prices failed to keep pace with cost development.

Meanwhile, the long awaited revival in PET resin sales did not materialise last month. However, PET prices managed gains of €70/tonne as a result of higher feedstock costs.

Source: nctww.com