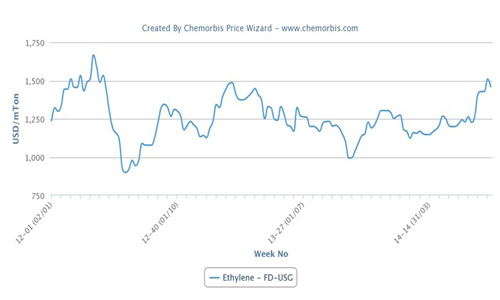

During the first week of April, spot olefin prices recorded renewed decreases in Europe mainly triggered by lower energy and naphtha costs as per the pricing service of ChemOrbis. In addition to the falling upstream chain, subdued demand from the derivatives market that resulted in adequate to long supplies also pushed spot ethylene and propylene markets down in the region.

Prior to the recent falls, spot olefin costs had already recorded continuous drops during the month of March, which had pushed April monomer contract settlements noticeably lower by €60/ton for ethylene and €50/ton for propylene compared to the March settlements. In the ethylene market, demand was considered muted in the wake of weak downstream PE demand over the past week. Trading activities were yet to revive after players returned to the market on Tuesday following the Easter Holiday, while relentless drops in naphtha costs also weighed down on the market.

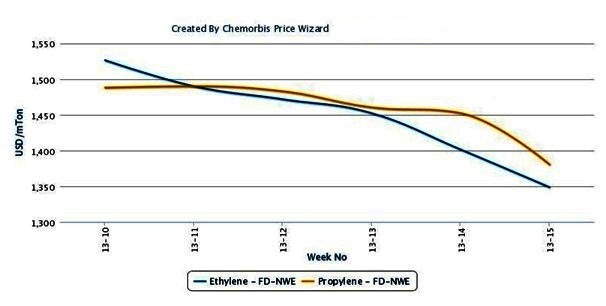

Spot ethylene costs were down €45/ton on FD NWE basis during the past week, bringing the total decrease amount to €125/ton with respect to a month ago. Market players in the region said that the ongoing cracker outages in the region failed to balance the availability which was considered long recently amidst persistently poor demand.

In the propylene market, spot prices declined €30/ton further on FD NWE basis since April started. The latest figures represented a larger loss of €90/ton when compared to early March. Scant demand from the downstream PP market was blamed as the main driver behind the bearish trend, while players in the region commented that supplies were comfortable.

In addition to the ongoing cracker shutdowns on the part of some producers during spring, several cracker operators are reportedly cutting their operating rates in an attempt to counterbalance sluggish demand in the spot olefins market. Total Petrochemicals started to implement a maintenance shutdown at their French cracker in April for two months, market sources reported, adding that the cracker has an annual capacity of 330,000 tons.

Looking at the upstream chain, spot naphtha costs decreased by around $40/ton on CIF NWE basis during last week, to indicate a $70/ton drop from a month ago according to ChemOrbis. Regarding energy costs, crude oil futures on the NYMEX for May deliveries plunged more than $4/barrel during last week, while ICE Brent crude oil prices for May delivery cargos plummeted by nearly $7/barrel in the same period.