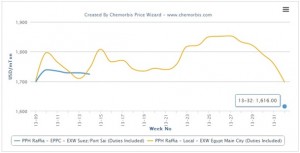

Egypt’s PP producer EPPC started to make offers to the local market prior to Ramadan holiday after an absence of four months, as per the pricing service of ChemOrbis. The producer had suspended making PP offers, pointing to the higher EPG/USD parity and lack of dollar reserves inside the country.

A source from the company noted, “We currently run our plant at normal rates and we encounter no production issues.” The source also highlighted that it is hard to judge the current demand situation in the market and added that it should be clearer as of next week.

Following the emergence of EPPC’s new prices, locally held PP raffia prices posted some decreases to match the producer’s level. Regarding the state of demand, players are not reporting brisk activities, although they hope that it should return to normal next week.

The Egyptian producer’s PP offers to the nearby Turkish market were also missing for almost three months. After having been seen in early May, Egyptian PP prices were absent from the market until the late weeks of July, when a couple of buyers secured some cargoes in limited tonnages. This week, a trader has started to offer Egyptian PP fibre at competitive prices as well. The producer’s offers are now forming the low end of the overall import fibre range in Turkey.

Egypt is an important source of PP supply for Turkey with more than 50,000 tons of homo PP imports in the first six months of 2013, one fifth of Saudi Arabia, according to ChemOrbis.