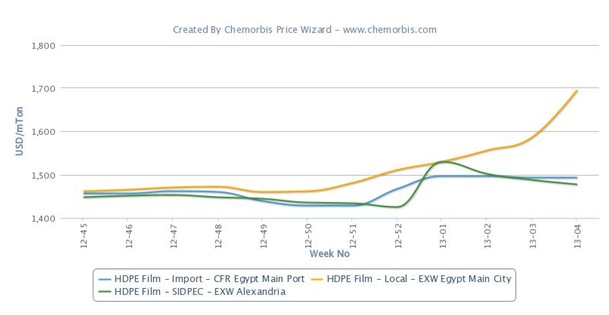

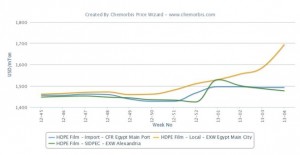

In Egypt, local PE markets recorded very noticeable increases with prices recording up to three digit hikes, as per the pricing service of ChemOrbis. Players have been complaining for some time about the difficulty in obtaining US dollars and the increasing exchange rate parity which makes importing difficult. Meanwhile, the local producer SIDPEC maintains their offer levels but the higher local market levels put pressure on the producer.

Looking at the import Middle Eastern prices, which were announced with increases for January, they are also traded below the current local market levels after adding $30/ton clearing and handling charges on top of them to localize. In the distribution market, LDPE film offers moved up by EGP900/ton ($136/ton) at both ends of the range during last week while LLDPE film prices gained EGP900-1000/ton ($136-151/ton), HDPE film moved up by EGP500-800/ton ($75-121/ton), HDPE b/m climbed EGP900-1100/ton ($136-166/ton) and HDPE inj. rose by EGP900-1200/ton ($136-181/ton) on ex-Egypt, cash including VAT basis.

Local HDPE film prices are $170-248/ton and HDPE blow moulding prices $194-236/ton higher when compared to the local producer SIDPEC’s prices while HDPE injection prices carry a premium of $251-298/ton from the producer’s offer levels. This situation puts an upward pressure on SIDPEC’s prices, which are announced on a monthly basis. Players were previously complaining about the producer’s delayed HDPE film deliveries but SIDPEC started to deliver HDPE film to the market during the previous week after a delay on switching their production line to HDPE film from blow moulding. The producer, who did not offer any HDPE injection to the market during the last month of 2012, started their HDPE injection deliveries as of January 20.

When comparing the distribution market levels to the import market, where the Middle Eastern suppliers had lifted their January prices, the local market carries a premium of $150-171/ton for HDPE film, $178-254/ton for LDPE film and $222-247/ton for LLDPE film after adding $30/ton clearing and handling charges on top of imports to localize them, as per ChemOrbis.

Buyers complain about these relentless increases amidst their weak end product demand and the difficulties in obtaining foreign currency. “We struggle to obtain our ordered quantities from the sellers,” some complain. Plus, overall purchasing power is hampered by the constantly rising dollar parity. Buyers complain about experiencing cash flow problems and sellers’ unwillingness to offer deferred payment terms. Some converters even report running their plants at reduced rates of around 60% capacity.