Eastman Chemical Co.’s three announced chemical recycling plants are at three very different stages at this point.

As production levels at a now-operational chemical recycling facility are expected to move higher in Tennessee, and concrete plans are being made for a second domestic site in Texas, the future of a third location in France has become unclear.

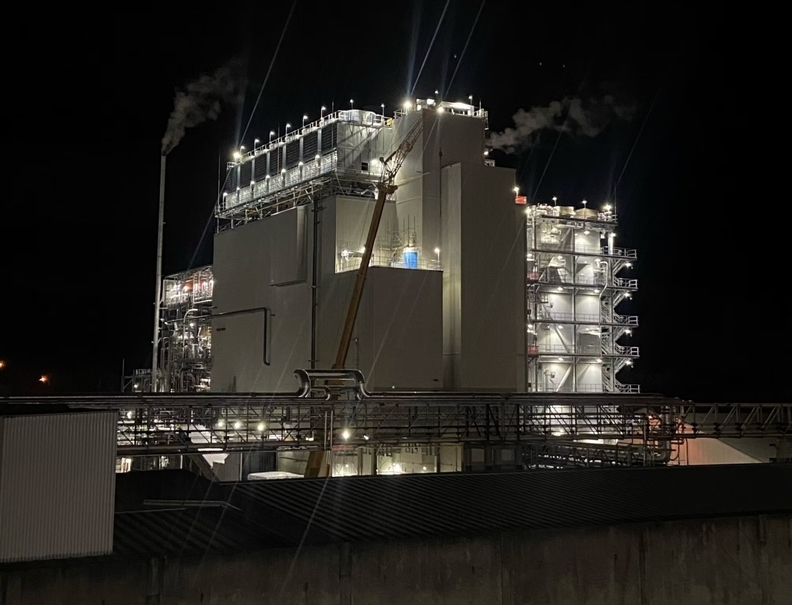

Eastman’s PET recycling plant in Kingsport, Tenn., has been able to run at about 70 percent of capacity and the company anticipates increasing production as the year progresses.

The company, based in Kingsport, indicated there has been feedstock preparation issues that caused downtime at the Tennessee location. But the company now expects higher output in the months ahead.

But while progress is being made in Tennessee, the company also said there is a question about whether a previously announced plant in France will actually move forward. A third facility in Longview, Texas, meanwhile, is a go.

Eastman uses a process called methanolysis at what the company describes as the world’s largest molecular recycling facility for plastics in Kingsport.

“We have demonstrated the ability to run the facility at operating rates of around 70 percent of design rates using a diverse feedstock slate,” CEO Mark Costa told stock analysts during a second quarter earnings conference call. “However, as we have broadened the use of hard-to-recycle material, we encountered feedstock preparation issues that led to downtimes longer than anticipated. We are addressing these issues with some basic equipment modifications.”

“There’s been one sort of small mechanical thing limiting us getting to 100 percent and we just recently made the change this week actually in fixing that one mechanical issue and we’re ramping up to full rates,” he said.

Chemical recycling — sometimes called molecular recycling or advanced recycling — is the broad description for a suite of different processes that break down plastics into chemicals that can then be reused for a variety of purposes, including making new virgin-like plastics. Methanolysis, as the name suggests, uses methanol in the process.

“We have made a lot of progress on improving the mechanical reliability issues that we were facing in the startup of the process that we shared with you in the first quarter call. So when we took a variety of corrective actions on the early failures around instrumentation, valves, routine equipment, especially pumps, that has been effective, and we’ve seen much higher reliability across the plant,” Costa said.

One product made through the methanolysis process is recycled dimethyl terephthalate, which Eastman has qualified for use in a broad range of polyester products, including Tritan for food-contact applications, the company said. More than 75 percent of the DMT used to feed the company’s largest Tritan line was recycled DMT and there was no difference in quality.

Eastman, also gave analysts an updated view on two other chemical recycling plants. It was just in March that the company announced plans to locate a second U.S. facility at company operations in Longview, Texas.

Costa made it clear that having PepsiCo Inc. as “a large contracted and committed partner” with that project was a key to approving construction of the facility. A U.S. Department of Energy grant also was important in making the decision.

Lacking a similar customer contract in France is “moving along a bit slower than we originally expected,” the CEO said. Eastman is trying to limit the impact of inflation on the project and lower capital costs as the company considers the future.

“I really hope we have clear insight by the end of the year of where that [French] project is headed. I wouldn’t say it’s necessarily a formal go/no-go decision, but we’ll have good insight as we go through the fall with customer contract discussions and finish the engineering work,” he said.

“The reality is, we have a lot of … portfolio options in how we manage these three plants and what products we put into each of them and what pace we build them. So we’re very excited about the first plant. We’re very excited about getting Texas built,” Costa said.

“But to be very clear, we’re sticking to our model, which is on the PET side. If we don’t get these long-term take-or-pay contracts as we did get with Pepsi, we will not build the French project,” he said.

Costa, in January 2022, announced with French President Emmanuel Macron plans to locate a facility in the Normandy region of France.

Eastman also reported second quarter profit of $230 million, or $1.94 per diluted share, on sales of $2.36 billion. That compares with a profit of $272 million, or $2.27 per diluted share, on sales of $2.32 billion for the second quarter of 2023.

The sales increase of 2 percent was primarily due to 6 percent higher volume partially offset by 4 percent lower selling prices, the company said.

Source: sustainableplastics.com