The buy-sell ideas for polyethylene (PE) and (PP) in China have widened due to diverse views on the potential impact of feedstock costs and imminent capacity additions in the country and Saudi Arabia, sources said on Wednesday.

The gap between buy-sell ideas was at least $50/tonne (€36/tonne) for most PE and PP grades for August shipment, the sources said. “Buying ideas for prompt shipment are around $1,120-1,130/tonne but there’s no buying interest even at this level if the cargo is for arrival by end August,” an Asian PP producer said. He was referring to the benchmark PP injection and yarn grades on a cost and freight (CFR) basis. PP injection and yarn grades of different origins were offered at $1,150-1,170/tonne CFR China for August shipment, industry sources said. “Selling ideas for Middle East and Asain film grade HDPE are at $1,250-1,300/tonne CFR China for August, but buying ideas are below $1,250/tonne,” a trader in south China said.

“Market opinion on the outlook is divided, with some buyers and sellers speculating that prices will rise further before falling off, and others expecting an imminent sharp downward correction,” said a trader in Zhejiang province in eastern China. Those buyers and sellers who expected resin prices to rise further were the ones who believed that upstream ethylene and propylene feedstock prices would remain firm in the coming weeks due to tight supply, and that crude prices would start rising again, Asian traders and producers said. “PE prices may rise again in the third quarter, but the fourth quarter is uncertain,” a Beijing-based trader said in Mandarin. “My traders said they are keeping above average stocks because they believe crude prices would go back up again, and that in turn would boost polymer buying sentiment and prices,” an Asian PP producer said.

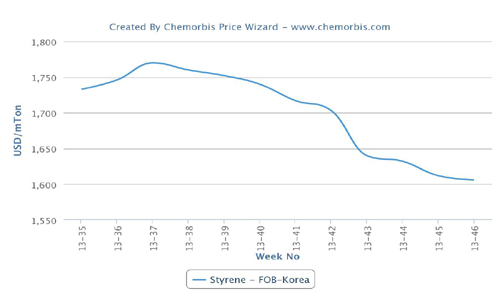

Weekly ethylene and propylene feedstock prices had risen by up to $60/tonne and $70/tonne, respectively, over the past two weeks due to tight supply, according to global chemical market intelligence service ICIS pricing. Crude prices had fallen by more than $10/bbl in the past month due to various factors, including the gloomy outlook on the global economy and tumbling equities markets. However, many other importers, including traders and end-users, said they were holding back purchases as they expected two new plants, namely Fujian Refining and Petrochemicals (FREP) in south China and Petro Rabigh in Saudi Arabia. would start supplying the market in September, causing prices to come under pressure then.

Asian producers had cited soaring ethylene and propylene feedstock prices as a bullish factor, but volatile crude prices in the past two weeks had led importers to believe that resin prices could fall in the coming weeks, the importers said. “We’re not looking to import resins now because it’s possible that prices may fall in the coming weeks, given the downtrend in crude,” a home appliance maker in south China said in Mandarin.

“Most end-users expect resin prices to fall because they saw crude prices falling in the past two weeks. The end-users don’t give much thought to feedstock costs,” the trader in Zhejiang province said. Some Asian polyolefin producers said they would cut production if resin prices were unable to cover the rising feedstock costs, but some converters were also looking to cut operating rates if they were not able to pass on the cost to their customers, he added.

Import activities had slowed down markedly throughout the PE and PP supply chains due to the uncertain outlook, industry sources said. Chinese traders were holding on to cargoes booked in the second quarter at lower costs and were also refraining from replenishing stocks, they said. “We’re in no hurry to sell because what we have in stocks now is low-cost material bought in the first half of this year. We’ll be selling this material in the domestic market and hence are waiting for domestic prices to rise further, so that we can maximise our margins,” said a second trader in Zhejiang province. “Due to uncertainty in the outlook, it’s better to keep the stocks now because if resin prices rise further, we’ll have to bear higher risks due to the higher restocking costs,” he added.

Source: nctww.com