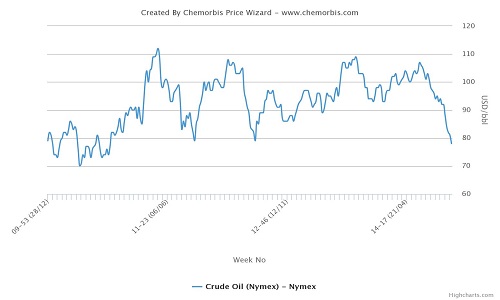

After having declared May PVC offers with large decreases across Asia, producers are now about to finish their May business as per the pricing service of ChemOrbis. They are also questioning if PVC is near the bottom, mainly pointing to the hopes about seeing better demand. Buyers, on the other hand, argue that these expectations about a nearing bottom have no clear justification while the market remains under downward pressure from bearish upstream costs and globally weak demand.

A major Taiwanese producer lowered its May offers to many Asian countries by $50/ton last week. This move was followed by other regional producers. A South Korean producer said, “We managed to conclude some deals after agreeing to $10-20/ton discounts after last week’s adjustments. Buyers in Southeast Asia remain hesitant while demand is strong in India. We believe that prices will change direction in June as several major producers are planning to raise their prices next month.”

The source from the producer also pointed out that Indian buyers continue to bid for lower offers while sellers are trying to hold prices stable or even lift them. “The high season for the Indian PVC market starts in May and lasts until the middle of June. Hence, there is no reason for buyers not to purchase during this period,” he added.

Other sellers also voiced similar expectations, sounding hopeful about a turnaround in May in line with the delayed high season for the construction sector. An acetylene based PVC producer in China commented, “We are already seeing some improvement in demand.”

Another Chinese producer, who reported stable export prices to India and Southeast Asia this week, said, “The PVC market has already hit our production costs. This is why we don’t think that any further softening is likely.” However, admitting that demand remains sluggish in Southeast Asian markets, a producer source acknowledges that it may be hard for prices to rebound. “We have managed to conclude some deals to India, but our sales are not as good as they were two weeks ago there either,” he said.

A major global trader also reported to have received lower bids than their discounted offers. “We don’t think these bids can be acceptable,” he said. Southeast Asian buyers prefer their domestic cargoes rather than buying imports of Far Eastern materials as they are not priced as competitively as their own regional cargoes, according to the trader. As for the near term, the trader prefers to monitor the market for a little while, although he opines that the PVC market is set to follow a stable to firm trend for June.

All the same, buyers across Asia are sticking to the sidelines in hopes of seeing some additional decreases according to ChemOrbis. Given the weakening upstream costs and the global downturn, buyers feel no rush to replenish stocks. “Now that import PVC offers are on a decrease, we are planning to wait some time more before securing our needs,” said a bag manufacturer in India.