Spot naphtha prices on a CFR Japan basis have reached a four month high, putting upward pressure on polymer prices in Asia, as per the pricing service of ChemOrbis. Spot naphtha prices currently stand nearly $115/ton higher than the levels reported at the same time last month, bringing spot prices to their highest levels since the end of April.

Higher upstream costs and reduced naphtha stocks in Japan were cited among the main reasons for the jump in spot prices, with a report from the Petroleum Association of Japan showing that Japanese naphtha stocks dropped 11% for the week of September 1 to reach 1.46 million litres. According to Reuters, naphtha exports from India and Europe are also becoming increasingly scarce, pushing traders to bid up prices to secure material. Stronger demand for gasoil was also cited as a factor pushing up naphtha prices.

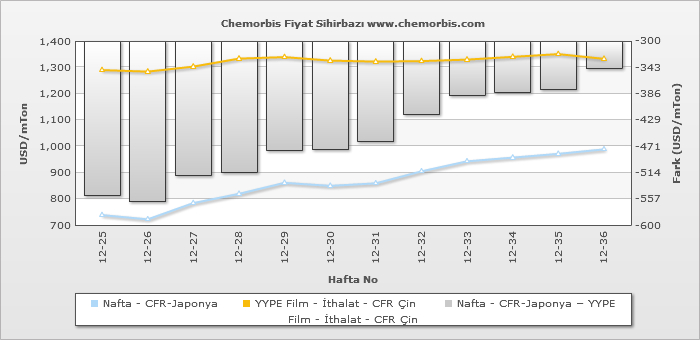

The increase in naphtha prices will help maintain upward pressure on Asian polymer prices, which have been gaining ground over the past few weeks on the strength of higher costs, although the rise in most polymer products has not been as rapid as the recent increases in naphtha prices, as per ChemOrbis. At the end of June, spot HDPE film prices on a CFR China basis were trading with a premium of slightly more than $560/ton from naphtha. This premium has been steadily shrinking over the past two months and now stands slightly below $350/ton.

The premium between homo-PP prices and spot naphtha prices has also been shrinking steadily over the past two months. At the end of June, spot homo-PP prices on a CFR China basis carried a premium of around $615/ton when compared with the prevailing spot naphtha prices. By the beginning of September, the premium carried by homo-PP over naphtha had fallen to just under $440/ton.