Spot olefin costs recorded increases in Asia over the week despite lower upstream costs and soft sentiment in downstream polymer markets, as per the pricing service of ChemOrbis. Spot propylene costs moved up slightly on the back of active buying interest, while ethylene prices soared owing to restricted spot availability.

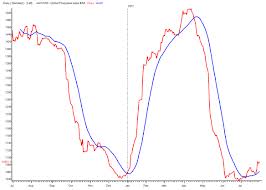

Crude oil prices on NYMEX fluctuated up and down to close the week on a bearish note. Futures contracts represented a drop of nearly $1.81/barrel for November delivery cargoes when compared to the previous week. Energy prices decreased by around $2.43/barrel since the month of October started. Lower crude oil costs led to a volatile trend in the spot naphtha market in Asia with prices fluctuating for most of last week. Spot naphtha offers in Asia softened $10/ton on CFR Japan basis on a weekly basis although they held mostly steady with respect to early October levels.

In spite of soft upstream costs and unsupportive downstream polymer markets, olefin prices in the region recorded weekly increases owing to limited supply and active buying interest earlier last week. Spot propylene offers gained $20/ton on FOB South Korea basis week over week. Market sources in the region reported a relatively active market scene before trading slowed down again. Demand from the end users’ side was reportedly muted in general given sufficient stock levels in line with limited activity in the downstream PP market. Meanwhile, prices still indicated a $30/ton fall when compared to the beginning of this month.

Spot ethylene prices recorded more significant gains with offers soaring $35/ton on CFR Northeast Asia basis on the week, as per ChemOrbis. Market sources attributed firmer offers to limited spot supplies in the region. When compared to the start of October, spot ethylene prices edged up around $5/ton. Looking at the supply side, Mitsubishi Chemical shut its 476,000 tons/year cracker in Japan earlier this month citing some power issues. Idemitsu Kosan was planning to restart its 623,000 tons/year Tokuyama cracker at the end of October following a maintenance that started early last month.

The cracker has a propylene capacity of 450,000 tons/year. Apart from these ongoing cracker shutdowns in Asia, several operators were running their crackers at lower rates. In Taiwan, CPC Corporation had cut the operating rates of its 380,000 tons/year cracker to around 80-85% citing government inspections by late last month. The cracker is able to produce 193,000 tons/year of propylene. In early October, Haldia Petrochemical lowered the capacity of its 670,000 tons/year cracker to around 40% in the first week of October. The cracker produces 330,000 tons/year of propylene.