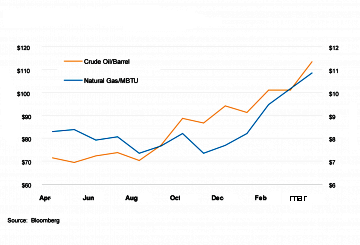

Oil fell as China’s export growth slowed and the International Energy Agency cut demand forecasts in signs that the global economic recovery is slowing.

Prices declined 0.5 percent as China’s customs bureau reported outbound shipments in July increased 1 percent from a year earlier after an 11 percent rise in June. It was the worst export growth since 2009. The IEA reduced its estimate of 2012 world consumption by 250,000 barrels a day to 89.6 million.

“There were hopes that we might see some decent demand growth in China but that’s looking less and less likely,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “The IEA reducing its forecast for oil consumption is a confirmation of people’s fears that demand is going to be weak.”

Oil for September delivery fell 49 cents to settle at $92.87 a barrel on the New York Mercantile Exchange. It decreased as much as 1.8 percent to $91.71 in intraday trading. Today’s decline trimmed a weekly advance to 1.6 percent. It was the fourth gain in five weeks.

Brent crude for September settlement decreased 27 cents to end the session at $112.95 a barrel on the London-based ICE Futures Europe exchange.

The July growth in Chinese exports was slower than the 8 percent median estimate in a Bloomberg survey. Imports rose 4.7 percent versus the survey estimate of 7 percent and a 6.3 percent increase in June.

Trade Surplus

“China’s export data point to troubles in the global economy,” said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. “The market is trying to consolidate. It seems to have some momentum on the up side even though it’s down today.”

Weaker exports reduced the country’s trade surplus to $25.1 billion in July from $31.5 billion a year earlier. The median projection was $35.1 billion.

“We are seeing a significant slowdown in China’s exports and it’s important to know that China is a big oil consumer,” said Carl Larry, president of Oil Outlooks & Opinions LLC in New York.

Customs data showed China’s net crude imports were 21.6 million metric tons in July. That’s the equivalent of 5.1 million barrels a day, the least since December. China used 9.76 million barrels a day of oil last year last year, making it the second-largest consumer, according to BP Plc (BP/)’s Statistical Review of World Energy, released in June. The U.S. is the leading user.

Oil Demand

The Paris-based IEA said oil demand will average 90.5 million barrels a day next year, down from 90.9 million estimated last month. It lowered its forecast for world economic expansion in 2013 to 3.6 percent from 3.8 percent last month.

“The economic crisis is taking a bigger toll than originally feared,” said Phil Flynn, senior market analyst at the Price Futures Group in Chicago. “The substantial slowdown in China really put a dent in oil prices.” Oil also followed losses in U.S. equities. The Standard & Poor’s 500 Index fell as much as 0.5 percent before rising after oil settled. The S&P’s GSCI Index of 24 commodities dropped 0.8 percent.

The 120-day correlation between price changes of oil futures and the S&P index rose to 66 percent yesterday, compared with 47 percent in April and the record 67 percent reached in July 2010. Oil, which settled above the 100-day moving average Aug. 7 for the first time in three months, settled below the average for the first time in four days. Buy and sell orders tend to be clustered near chart-support levels such as moving averages.

Next Week

Crude may rise next week as refineries operate near the highest level in five years and as tension in the Middle East raises concern that supply may be disrupted, a Bloomberg survey showed. Ten of 21 analysts, or 48 percent, forecast crude will advance through Aug. 17. Eight respondents, or 38 percent, predicted that futures will fall and three said there will be little change in prices.

Electronic trading volume on the Nymex was 420,729 contracts as of 3:11 p.m. in New York. Volume totaled 558,206 contracts yesterday, 1.1 percent above the three-month average. Open interest was 1.46 million.

SOURCE : http://www.bloomberg.com/news/2012-08-10/oil-falls-most-in-a-week-on-china-exports-iea-forecast.html