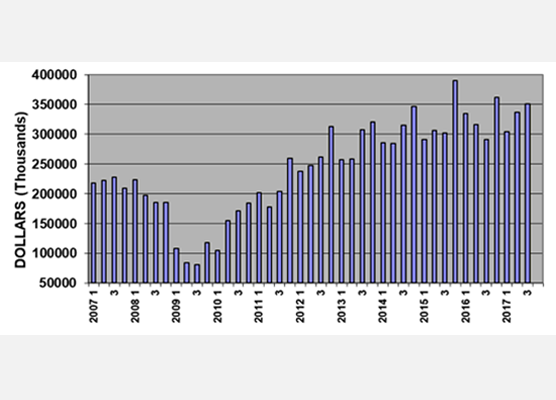

North American shipments of primary plastics machinery posted a strong year-over-year increase in Q3 of 2017 according to statistics compiled and reported by the Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES). This marked the second consecutive quarterly Y/Y increase in this data.

The preliminary estimate for shipments of primary plastics equipment (injection molding, extrusion, and blow molding equipment) for reporting companies totaled $350.8 million in the third quarter. This was 20.4 percent higher than the total of $291.3 million in Q3 of 2016, and it was 4.0 percent stronger than the revised $337.2 million from Q2 of 2017. This Y/Y gain in Q2 followed a revised 6.5 percent Y/Y increase in the quarterly total from Q2.

“After hitting a plateau in the second half of 2016, the upward trend in the shipments data for plastics equipment re-emerged in the third quarter of 2017. Quarterly gains of 20 percent will not be sustained going forward, but the plastics industry is entering the New Year with more momentum than it did a year ago. I still expect the underlying economic fundamentals in the U.S. to push higher, and global demand will also improve in 2018,” according to Bill Wood, of Mountaintop Economics & Research, Inc.

PRIMARY PLASTICS EQUIPMENT SHIPMENTS

The shipments value of injection molding machinery increased 21 percent in Q3 when compared with last year. The shipments value of single-screw extruders declined by 2 percent. The shipments value of twin-screw extruders (which includes both co-rotating and counter-rotating machines) jumped 61 percent. The shipments value of blow molding machines was not reported in Q3.

Demand for auxiliary equipment also appeared to be strong in the third quarter according to the latest estimate for total bookings. Actual comparisons in this year’s quarterly auxiliary data to last year’s quarterly totals are unavailable due to a change in the number of reporting companies.

The strong results in the CES machinery data in the third quarter were matched by solid gains in two other data series that track the U.S. industrial machinery sector. According to data compiled by the Census Bureau, the total value for new orders of US industrial machinery escalated 8 percent in Q3 of 2017 when compared with last year. And according to data compiled and reported by the Bureau of Economic Analysis (BEA), business investment in industrial equipment increased 7.6 percent (seasonally-adjusted, annualized rate) in Q3 of 2017 when compared with the previous year.

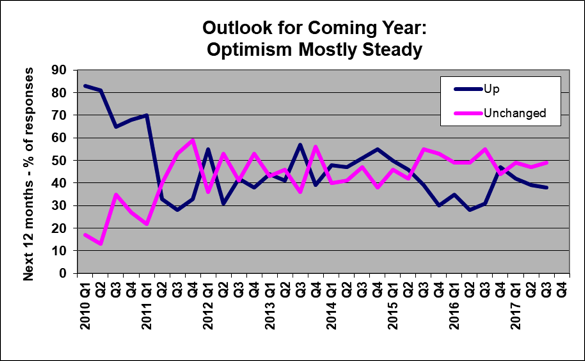

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about their future expectations. According to the Q3 survey, 87 percent of respondents expect market conditions to either hold steady or get better during the next year. This is up slightly from 86 percent in Q2.

Global market conditions in the coming year are expected to come in steady-to-better. This is a bit more optimistic than the outlook in Q2. Expectations for North America improved slightly. Expectations for Latin America and Europe were little changed. Expectations for Mexico declined, but there was a big increase in positive sentiment for Asia in the coming year.

The respondents to the Q3 survey currently expect that packaging will be the strongest end-market in the coming year. The outlook for demand from the electronics sector also improved. The outlook for all other major end-markets called for steady-to-better conditions.

# # #

The industry and survey analysis that appears in this media report was contributed by Bill Wood of Mountaintop Economics & Research, Inc., a supplier of market analyses and forecasts for decision makers in the plastics Industry. Mr. Wood is a plastics market economist with more than 30 years of experience in industrial market analysis and forecasting. ([email protected])

# # #

The PLASTICS Committee on Equipment Statistics (CES) collects monthly data from manufacturers of plastic injection molding, extrusion, blow molding, hot runners and auxiliary equipment. A confidential, third-party fiduciary, Vault Consulting, LLC, compiles the monthly data and analyzes individual company data for consistency and accuracy. Once this crucial process is completed, Vault aggregates and disseminates reports to participating companies. If this is something you and your company are interested in please contact Katie Hanczaryk at[email protected] or 202-974-5296.

# # #

Plastics Industry Association (PLASTICS), formerly SPI, is the only organization that supports the entire plastics supply chain, representing nearly one million workers in the $404 billion U.S. industry. Since 1937, PLASTICS has been working to make its members and the industry more globally competitive while advancing recycling and sustainability. To learn more about PLASTICS’ education initiatives, industry-leading insights and events, networking opportunities and policy advocacy, and North America’s largest plastics trade show, NPE: The Plastics Show, visit PlasticsIndustry.org. Connect with PLASTICS on Twitter, Facebook and LinkedIn.

.