As reported on ChemOrbis.com, import PVC prices have been on a steady downward path in Turkey since the second half of May. Tepid demand and sufficient supply are blamed as the main reasons behind the ongoing downturn while upstream ethylene costs have also played a vital role in setting the tone of the market.

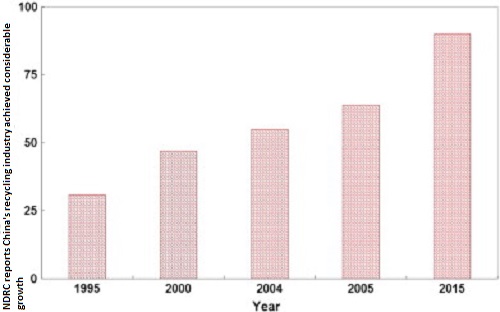

Due to the recent decreases in the PVC market, the current market level is below the last bottom hit in early February of this year, according to ChemOrbis Price Index. Going further back, the current offers represent the lowest levels seen since May 2009. “It has been a long while since I saw both US and European PVC prices this low,” said a trader.

Local dynamics combined with global events are contributing to the weak atmosphere of the PVC market. Europe continues to see sufficient supplies while Asian markets generally indicate a soft trend this month in the midst of unsatisfactory demand and improving availability. Offers out of the US were lower as well as a result of thin buying interest from its major export destinations.

Regarding US PVC, there has been a noticeable slump in buying interest from Turkish buyers, part of which is attributed to the change in the antidumping duty while others blame the dampened export business of Turkish converters.

According to ChemOrbis Import Statistics, Turkey’s PVC imports declined by 15% in the first 8 months of this year when compared to the same period of last year. PVC imports from the US to Turkey indicated a 23% fall in January-August this year, while imports from France also declined 20% on a yearly basis. Players expect to see further losses in PVC imports for the rest of this year while September data is expected to be revealed soon.