Players in India are voicing their expectations of seeing more competitive PVC prices in the days to come as per ChemOrbis. This is mainly justified by falling production costs while the general demand status also lends to this view due to the ongoing monsoon season.

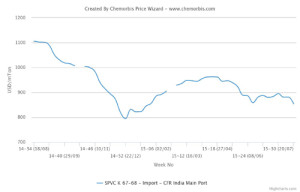

Import PVC prices in India have been on a softening trend since early June with prices losing around $30/ton on average in the last two and a half months, according to ChemOrbis Price Wizard.

This week, import offers edged further down due to a number of dynamics. Crude oil futures on the NYMEX touched as low as almost $43/barrel recently, hitting the lowest level seen since mid-March, 2015. Spot ethylene prices in Asia plunged around $110/ton on CFR Northeast Asia basis week over week, while most of the decrease appeared by the middle of this week.

Apart from feedstock markets, competitive Iranian, Brazilian and American PVC prices have been offered in India’s import market for some time now, which reinforces the pressure on the market. A trader based in India reported purchasing some Iranian PVC. He commented, “Sentiment is bearish and this is keeping purchasing amounts limited. In addition, the ongoing monsoon season is also hampering demand.”

Another trader who purchased some Iranian and acetylene based Chinese PVC this week argued, “Most pipe manufacturers are operating at around 50-60% of capacity and therefore not purchasing large amounts of PVC. Iranian PVC is very competitive while Chinese acetylene based cargoes are not attracting interest due to the high anti-dumping duties on this product. We believe that a Taiwanese major will lower their September offers by up to $30/ton given retreating ethylene costs.” Fresh September offers from the producer are widely expected to emerge early next week with some drops.

Another Indian trader confirmed, “Competitive offers for Iranian and Brazilian cargoes remain in place in the market. We also received an export offer from the US which would come to an attractive level on CIF India basis.”

According to ChemOrbis, a pipe maker stated, “Our operations are still affected by the monsoon which is expected to last until the end of September. We failed to ramp up our operating rates to 40% given weak demand. Meanwhile, if ethylene costs in Asia continue to plummet, we expect a Taiwanese major to return with price cuts.” Most pipe converters will have to replenish inventories in September since demand could pick up again in October, according to another buyer. Heavy rain has been causing floods in some parts of India for a while now.