Futures dropped as much as 0.6 percent, extending yesterday’s 2.3 percent decline, after Standard & Poor’s Ratings Service cut the U.S. long-term credit outlook, fueling concern a recovery in the global economy may slow. In Europe, a report today may show manufacturing growth slowed while speculation mounts that the region’s debt crisis is worsening.

“Jitters among investors around the outlook is causing a bit of a sell-off,” said Ben Westmore, a minerals and energy economist at National Australia Bank Ltd. in Melbourne. Oil “seems to be following what’s happening in the equity markets,” he said. “There was also some resurgence around the euro debt concerns.”

Crude oil for May delivery slid as much as 61 cents to $106.51 a barrel in electronic trading on the New York Mercantile Exchange and was at $106.57 at 12:38 p.m. Singapore time. Yesterday, it declined $2.54 to settle at $107.12, the lowest since April 13. The contract expires today. The more- actively traded June futures fell 56 cents to $107.13.

Brent crude oil for June settlement traded at $121.25 a barrel, down 36 cents, on the London-based ICE Futures Europe exchange. Yesterday, the contract slipped $1.84, or 1.5 percent, to $121.61, the lowest since April 12..

Equities Slip

Standard & Poor’s put the U.S. government on notice that it risks losing its AAA credit rating unless policy makers agree on a plan to cut budget deficits and the national debt. Concern that Europe’s debt crisis is worsening sent Greek and Portuguese bond yields surging.

The purchasing managers’ index for euro-region manufacturing dropped to 57.0 in April from 57.5 in March, according to the median estimate of economists in a Bloomberg News survey before the data due today. Readings above 50 indicate expansion.

The MSCI Asia Pacific Index slid 1.4 percent to 133.77 as of 11:45 a.m. in Tokyo. About eight shares dropped for each that gained. Japan’s Nikkei 225 Stock Average tumbled 1.5 percent while futures on the S&P 500 Index fell 0.5 percent.

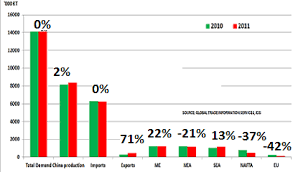

Oil declined yesterday after China increased banks’ reserve requirements to cool inflation, signaling fuel demand growth may slow, and Saudi Arabian Oil Minister Ali al-Naimi said that the market is “oversupplied.” The kingdom is the world’s biggest crude exporter.

An Energy Department report tomorrow may show U.S. crude inventories increased 1.4 million barrels last week from 359.3 million, climbing for a seventh week, according to analysts surveyed by Bloomberg News.

$80 Crude

Oil traders have turned $80 crude into the second-biggest bet in the options market as a surge in futures to the highest level since 2008 spurred concern that demand may tumble.

Open interest, the number of contracts held by traders, has more than doubled since January for $80 put options for December 2011 and 2012 as New York futures last week touched a 30-month high of $113.46 a barrel. The two puts, bets that prices will fall, account for 21 percent of the open interest among the top 10 contracts traded on the New York Mercantile Exchange.

Options contracts that give investors the right to sell December 2012 futures at $80 a barrel rose 21 cents to $4.76 a barrel in electronic trading yesterday on the Nymex. December 2011 $80 puts gained 15 cents to $1.34.

Libya Production

Prices surged last week as fighting in Libya threatened to prolong supply cuts from Africa’s third largest producer. The United Nations has reached an agreement with Muammar Qaddafi’s regime that permits aid workers and supplies into Misrata, the Libyan city that has been pounded by government forces in their push to reach the port that provides the rebels’ lifeline for food and weapons.

The unrest is the bloodiest in a wave of uprisings that has toppled leaders in Egypt and Tunisia and spread to Algeria, Bahrain, Iran, Oman, Syria and Yemen. Libya’s crude production, which averaged 1.6 million barrels a day last year, shrank to 390,000 barrels a day in March, according to a Bloomberg News survey of producers, analysts and companies.

“The continuing conflict in Libya and the prospect of that spreading is still something to watch,” National Australia Bank’s Westmore said.

In Nigeria, the incumbent leader, Goodluck Jonathan, won a presidential election as violent protests against the result killed at least six, underscoring the political frailty in Africa’s biggest oil producer.

Source : www.bloomberg.com