TODAY IN THE MARKETS:

Refinery grade propylene traded lower Friday and ethylene traded once on an index basis. NGLs and energies were mixed. Spot resin trading was active as domestic and export demand persisted.

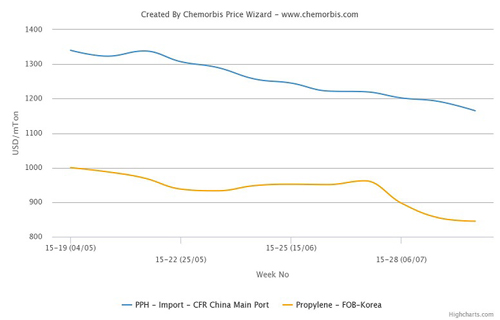

April RGP traded at 22 cpp and 22.625 cpp for confirmed pipeline delivery. This is down from a Thursday deal done at 23.375 cpp. The day ended with April RGP bid at 21.125 cpp against no offers. No spot polymer grade or chemical grade propylene deals were confirmed Friday. The day ended with April PGP offered at 26.75 cpp against no bids.

No fixed-price ethylene spot deals were confirmed. An April spot deal was done on the PCW index. The last fixed-price ethylene deal was done Thursday at 23.5 cpp for April delivery. The day ended with April bid at 23 cpp and offered at 25 cpp. 2Q was offered at 25.5 cpp (Eq and Wms system) against no bids. Second half swaps were bid and physical pounds were offered on an ethane formula basis.

In production news, Formosa’s olefins 2 cracker at Point Comfort remained shut for repairs. The unit is expected to resume operations around April 8. ExxonMobil’s Beaumont olefins unit remained shut, and a restart date has not been disclosed. Shell’s GO-1 cracker in Norco is expected to resume operations in mid-to-late April. One of Dow’s crackers at St. Charles is also shut, and a restart date has not been disclosed.

Energies and NGLs were mixed. Crude oil fell $1.13 ending at $51.51/bbl. Natural gas was up 2 cents at $3.801/mmBtu. Ethane was up a half cent at 34.75 cpg. Propane was flat at 65.25 cpg. Butane fell 1.5 cents at 85.5 cpg. Iso was down 1.5 cents at 101.875 cpg. Natural gasoline gained 0.5 cents ending at 109 cpg.

The spot resin market ended the week with a flurry of transactions, and prices were higher. The market was active this week amid strong export demand and lean domestic inventories. Generic prime railcars of LLDPE film butene were up about a half-cent in the low-to-mid 40s cpp range. HDPE blow mold was in the low 40s cpp range, and HDPE injection was trading in the low-to-mid 40s cpp. HoPP was in the high 30s cpp, and CoPP was in the high 30s cpp to low 40s cpp.

In the contract market, producers are seeking to implement a 5-cent increase for PE, and some have said they will seek a 3-cent increase for PP in April. Processors have expressed doubt that these increases will be implemented, citing lack of clear demand downstream.

Source: petrochemwire.com