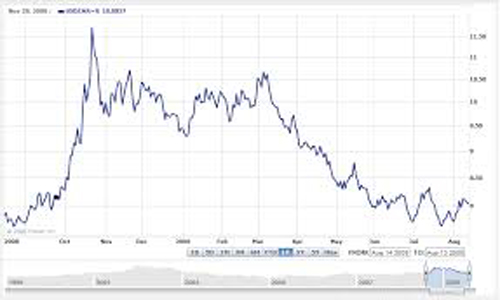

Ethylene and refinery grade propylene each traded once Friday while NGLs and energy slid. Spot resin prices were stable from yesterday but ended the week higher.

A 2H 2009 ethylene strip traded on an ethane formula basis (Wms system). No fixed-price deals were confirmed. The day ended with ethylene bid at 23.5 cpp for March and at 24.5 cpp for April. Forward markets were confirmed stretching out through the end of the year on an ethane formula basis. The last fixed-price ethylene deals were done Wednesday at 24.5 cpp for March and 24.125 cpp for April.

Refinery grade propylene traded at 19.75 cpp for April. Pipeline-delivered RGP was bid during the day at 20.5 cpp for March and April against no offers. RGP traded this week in the 19-20.5 cpp range for delivery via several modes in March and April. No polymer grade propylene deals were confirmed Friday. PGP traded Thursday at 26.1 cpp for March and 25.5 cpp for April.

In production news, a few Gulf coast steam crackers remain shut. Markwest’s Javelina offgas facility remained shut and is expected to resume operations on March 31. Shell’s GO-1 cracker at Norco is expected to resume operations in mid-to-late April. Eastman’s 3A cracker at Longview is shut indefinitely. One of Dow’s crackers at St. Charles remains shut, and a restart date has not been disclosed. Chevron Phillips’ Sweeny 22 cracker is also down and a restart date has not been disclosed. ExxonMobil’s Beaumont olefins unit has been shut since September of 2008 and a restart date has not been disclosed.

Energies and NGLs traded lower Friday. Crude oil shed $1.96 to end at $52.38/bbl. Natural gas was down 32 cents ending at $3.631/mmBtu, a 7-year low. Ethane fell 0.75 cents ending at 32.25 cpg. Propane slid 2.625 cpg to end the day at 68.125 cpg. Butane was 4.5 cents lower at 87 cpg. Iso shed 3.75 cents to 102.75 cpg. Natural gasoline was down 3 cents at 108.75 cpg. April benzene was 2-3 cents higher at 169-172 cpg DDP and 171-173 cpg FOB. May was 172-174 cpg DDP.

Spot resin prices were slightly higher at the end of the week. Processors continue to search for incremental volumes to supplement lean inventories, while traders have worked down their stocks and have kept offers steady or slightly higher. A bump in export demand to several locations, including Latin America and China, has supplemented lagging domestic resin consumption, market participants said. Traders said that HoPP prices were about a penny higher this week around 33 cpp FOB Houston warehouse, and in the high 30s cpp for domestic delivered railcars. LLDPE film as well as HDPE blow mold and HDPE injection were about a half-cent higher this week, in the low-to-mid 40s cpp. Traders said the lower end of the range for bagged material in Houston-area warehouses.

Source:petrochemwire.com