On Thursday, global players came together in Istanbul at ChemOrbis 2nd Annual PVC Event to discuss the PVC market, with several of the players emphasizing the impact from North America. A representative from Wood Mackenzie, Patrick Kirby, noted that despite the collapse of the housing bubble, shale economics have created value, allowing up to 39% of total US PVC production to be exported.

In his presentation titled, “Rising Power: PVC Industry in North America and its Reflection on the Rest of the World”, he reviewed US ethylene developments, and their impact on the North American PVC market. He then explored whether increasing US export volumes would continue as the new “normal”. For the future, he believes ethylene integration is the key differentiator going forward and already US producers have declared their plans to build crackers to capture the ethylene margin. In 2013, US producers had an $800/ton ethylene advantage in North America relative to Asian producers. Afterwards, he outlined the strategies of each of the US PVC producers to clarify their positions in the market and their strengths going forward.

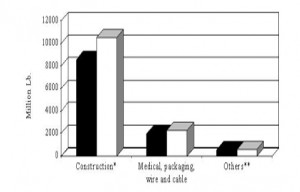

Another consultant, Dr. Nuno Faisca, Senior Consultant, Energy & Chemicals Advisory in Nexant UK gave a presentation entitled, “Chlor-Alkali and Global Feedstocks Scenario Assessment” which discussed opportunities in the vinyls value chain. In the US, both ethane and propane are giving a competitive edge for ethylene derivatives and for now, propane in the US is being priced below other regions until export facilities are built. Dr. Faisca reviewed the outlook for chlorine and caustic soda as well as the EDC market. In the VCM market, Asia has almost exclusively contributed to global VCM growth and will continue to drive demand. For the next five years, demand for PVC will be driven by an emerging middle class in Asia, which will require an expansion of housing and urban infrastructure. Finally Dr. Faisca reviewed the latest technology in the PVC industry plus, the pricing scenario, highlighting that lower crude oil does not necessarily mean lower profitability for the PVC industry.

Kerem Kocaoglu, Sales Group Manager of Petkim discussed Turkey’s growing import market including the role of US PVC in that market. He noted that the domestic producer, Petkim, accounts for just 15% of the PVC market share and that the PVC market in Turkey is growing at 2.9% per year. This is supported by the young population and government support in the construction sector over the last ten years. He also noted that American PVC has been steadily taking over market share from European sources since 2003, with the US showing a positive 22% change in market share between 2003 and 2013. According to ChemOrbis Import Statistics, the US was by far the largest PVC provider to Turkey in 2014.

Further information on the Turkish market was provided by Necmettin Kaymaz , Chief Project Director for the Republic of Turkey for the Prime Ministry’s Investment Support and Promotion Agency of Turkey (ISPAT). Mr. Kaymaz made note of Turkey’s strong economic conditions and the fact that the country is supported for further growth by the large and growing population. He highlighted that Turkey is emerging as a manufacturing hub, geographically conveniently located between major centers. Turkey is currently the largest TV and white goods manufacturer and largest commercial vehicle manufacturer in Europe. It will become the 2nd largest manufacturing hub in Europe and the 16th largest worldwide. The country’s construction sector is one of the main components of the economy, accounting for 5.9% of GDP. The construction sector has seen 19% CAGR since 2006 and has attracted more than $34 billion in foreign direct investment (FDI).

Andrey Alabin, Head of Polymers Department for BASHKIM reviewed the PVC market in Russia and the CIS countries. In Russia there is a production capacity of 710,000 tons/year of suspension PVC and with consumption of over 900,000 tons/year, the country needed to import around 280,000 tons in 2014. This is the lowest import figure since 2010 after five years of a steady year-over-year decline in imports. The decline in imports last year came despite the drop in customs duties from 10% to 6.5% in September 2014. Over this five year period, US PVC was a main contributor, while in 2014, it is estimated that China will take the greater share. In 2015, it is estimated that supply of PVC will grow in Russia while demand will decline creating a nearly self-sufficient market. Similarly in Ukraine, PVC imports dropped in 2014 to around 110,000 tons/year with the US accounting for 45% of that. However, the Ukraine implemented a 6.5% duty on all PVC imports.

Another region discussed at the conference was India. Akhilesh Bhargava, Managing Director of AVI Global Plast Pvt. Ltd, noted that PVC imports into India are slightly over 1 million tons/year and he forecast that figure would grow to near 1.5 million tons starting this year. He outlined the five main Indian producers and their capacities. In the past two years, Taiwan was the main supplier to the country, far outpacing the US and this trend is forecast to last until 2018 due partly to differences in anti-dumping duties. On the other hand, he noted that Japan has a great opportunity to increase its import market share in the country.