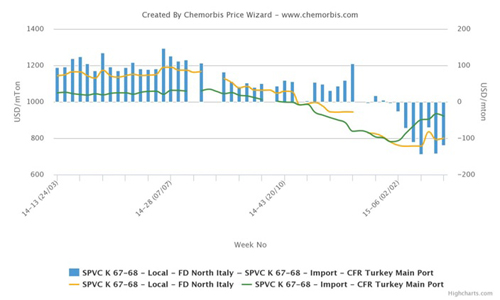

In Italy’s PE market, players started to close their January transactions with increases ranging from €20/ton to €40/ton this week with buyers obtaining slight discounts from initial hike requests as per the pricing service of ChemOrbis. Early expectations regarding February have been expressed amongst players recently. These expectations mostly center on rollovers for now as players are aware of the possibility that the recent falls in monomer costs may put a cap on a new series of hike attempts.

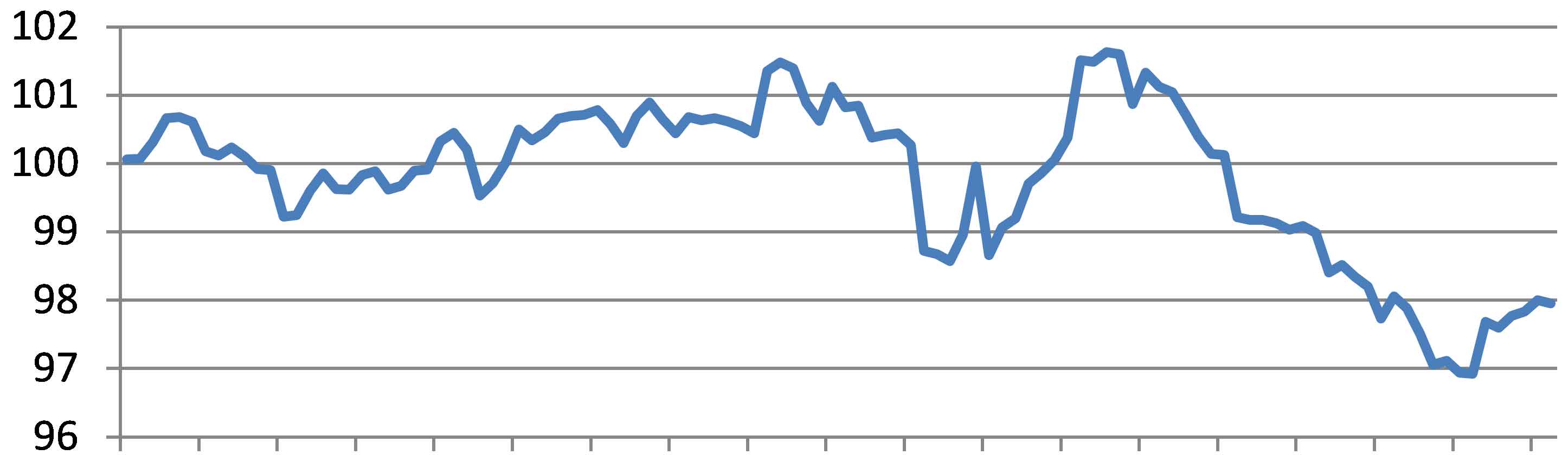

Looking upstream, spot naphtha costs edged down by around $10/ton since the month started owing to the fluctuating energy complex during the period.Spot ethylene prices in Europe slumped by €50/ton on FD NWE basis this week while recent figures indicate a €35/ton fall from early January. Unless prices rebound heading to the end of the month, lower spot ethylene costs could prevent a bullish outcome for new contract settlements in the region.

A distributor stated, “We could sell some small volumes this month after adjusting our hike requests down to match buyers’ bids.” A second distributor said that demand conditions in the PE market are slow due to the low season for some of the end applications. He expects to see rollovers to €20/ton increases in February. “Deals may be concluded with rollovers from January though,” he said. “Sellers may seek €20/ton hikes for next month whereas they will likely obtain only rollovers due to really weak PE demand,” another concurred.

On the buyers’ side, a shopping bag maker reported purchasing some LDPE after his supplier revised his price down by €10/ton. A manufacturer from the packaging sector said, “We purchased only LDPE as we still had some volumes for HDPE and LLDPE. We don’t think that prices will come down next month as producers may seek some hikes. However, the market may turn down in March.”

A film converter, in the meantime, preferred not to secure any cargos this month considering his slow end business and commented that supply is tight.

According to ChemOrbis, a food packaging converter in Germany complained, “Our end product demand is not as strong as it had been in the same months of the previous years.” The buyer believes that PE prices may come with rollovers or even with some discounts next month.” Another packager in the country reported that he is yet to conclude his monthly deals but he plans to pay smaller hikes than he was asked for especially for LDPE. “The PE market will probably see rollovers in February,” he noted.