In China, domestic PP and PE prices have been recording consecutive increases for about eight weeks since late June. Domestic PP prices started to show some signs of stabilization this week while domestic PE prices, which followed a steady trend for the past two weeks, started to soften in the current week. According to ChemOrbis Price Index, average domestic homo-PP prices on an ex-warehouse basis recorded around $110/ton increases since end-June but they retained their last week’s levels this week.

Overall trading activity was reported to be slow in the PP market while the local PP producers CNPC and Sinopec mostly kept their prices stable. A trader commented, “We agree to offer slight discounts in order to entice better buying interest but since the local producers have not changed their prices and overall supply levels are limited from the import sellers and the replacement costs remain high, we are not planning to decrease our prices rapidly. We prefer to observe the import sellers’ pricing policies in order to have a clearer view on our prices.”

A converter also confirmed steady levels from the local producers CNPC North China and Sinopec and added, “We received stable to slightly softer offer levels this week. Distributors offer small discounts in order to be able to conclude deals but buyers, who lack confidence on the market trend over the near term, continue to meet their minimum needs.”

A distributor reported, “We received CNY100/ton ($16/ton) lower PP offers from Sinopec Guangzhou but CNPC South China continues to keep their prices stable at the moment. Therefore, we adjusted down our PP offers slightly along with the producer’s pricing policy in order to be able to sell easier. However, import PP offers on FCA basis remain stable when considering the limited availability and higher replacement costs from the overseas producers.”

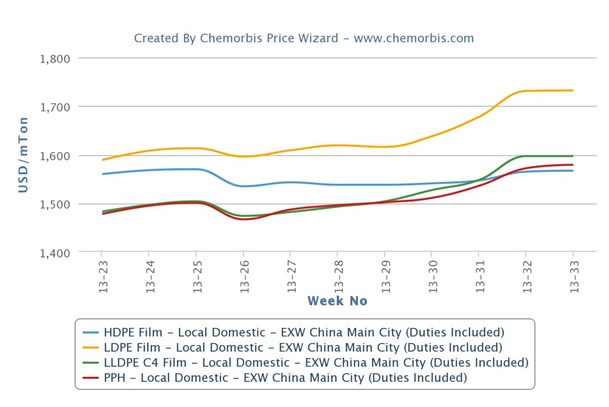

In the PE market, a similar panorama was observed for the past two weeks, when local domestic prices showed a steady trend for LDPE, LLDPE and HDPE film before recording some decreases this week. According to ChemOrbis Price Index, local domestic LDPE film prices lost an average of $30/ton this week while HDPE and LLDPE film prices recoded smaller decreases of around $5/ton with respect to the previous two weeks, when prices portrayed a stable trend after recording consecutive increases since end June.

A trader said, “Local market sentiment is not healthy this week given the local producers’ price cuts coupled with decreasing LLDPE film futures prices. We keep our offer levels stable from last week in the distribution market but we are willing to offer slight discounts in return for firm counter bids. At the moment, we prefer to work with limited stocks given the higher import costs.”

Another player remarked, “Local producers issued further decreases on their offer levels while LLDPE film futures prices continue to decline. Despite the fact that we received lower local PE prices, we remain hesitant to make fresh purchases as we hope to see lower prices in the days ahead despite the approaching high season for agricultural film and the fact that we recently raised our operating rates. At the moment, we deem local PE offers as more competitive when compared to imports.”

A buyer said, “Lower LLDPE film futures and local producers’ cuts weighed down on the market sentiment although some sellers continue to be reluctant to offer discounts. We, at the moment, prefer to remain sidelined from the market in order to have a clearer view, although we think that there is a chance that local producers might elect to lower their prices further if they face stock pressure amidst weak buying interest. We receive a limited number of orders for our end products but we hold sufficient stock levels to meet these orders. We plan to continue to make hand-to-mouth purchases” according to ChemOrbis.