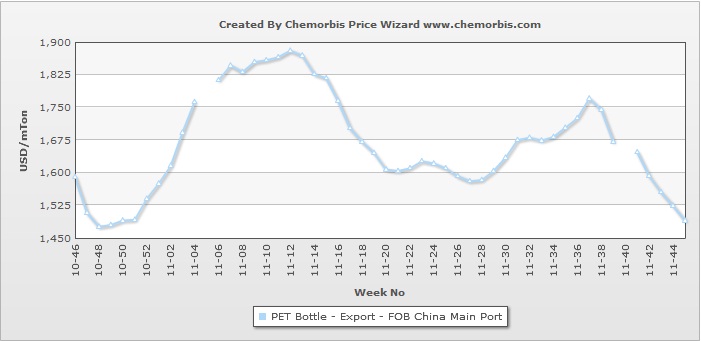

In China, export prices have been steadily firming up since July on the back of the higher energy prices and firmer upstream costs. However, during this past week, export prices out of the country saw some stabilizing owing to the slowing demand stemming from the holidays which occurred in major export destinations. Europe has been on their summer holidays and the previous week was Ramadan holiday in Muslim countries. However, some producers continued to issue increases on their prices, which still remained within the overall offer range.

Looking at this past week’s export prices given by Chinese producers, the overall range indicates no changes from the previous week on FOB China basis. In upstream news, spot PTA prices are stable at early August levels while spot MEG and PX prices gained $10/ton and $15/ton, respectively. The upstream market indicates even greater increases when compared to the early July levels. Current PTA prices are $50/ton higher while PX is $70/ton firmer and MEG is $170/ton above the early July levels. Meanwhile, an initial September MEG contract has already been announced to Asia with $70/ton increases from August.

A producer based in Shanghai commented, “Our done deal levels remained stable this week due to the stable PTA prices on a week over week basis and slowing trading activities. We do not think that prices are likely to see any further increases over the short term since buyers have been acting cautiously on making fresh purchases. Plus, new capacities are to come online in September when the high season for PET will start fading away.”

Another producer said, “We issued a $10/ton increase on our export prices considering the fact that most feedstock costs are still firm and we are still operating with negative margins. We are planning to remain firm regarding our offer levels over the short term despite the fact that we received a limited number of orders since most of our customers, who operate out of China, were on holiday.”

A different producer also reported issuing increases on their export PET prices by $20/ton. The producer highlighted the higher feedstock costs and their squeezed margins for their hike decision. “Yet we met some resistance towards our prices as buyers found our new levels too high. Therefore, we only could conclude deals for small amounts,” he further added.

A trader also confirmed receiving higher export prices from domestic Chinese producers. He noted, “We received $10-20/ton higher export prices but we were hesitant to make fresh purchases as we lacked confidence regarding the future market trend. Therefore, instead of making fresh purchases, we preferred to observe the feedstock markets,” he underlined.

A Chinese producer also commented, “This past week, we experienced slow trade as buyers showed some resistance towards our offer levels. Therefore, we offered some discounts, albeit in small amounts and for only some buyers, in order to conclude deals.”Producers continue to highlight their low stock levels and squeezed margins in order to justify their firm stance regarding their current offer levels and their reluctance towards giving discounts.