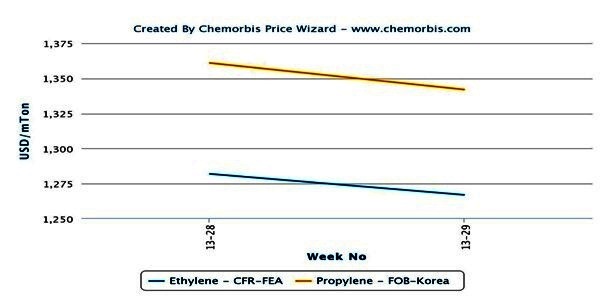

In Asia, spot ethylene and propylene prices moved lower despite firmer energy markets as per the pricing service of ChemOrbis. Crude oil futures on the NYMEX capped a fourth weekly gain to hit a 16-month high of $108.05/barrel on July 19 after Moody’s Investors Service revised the U.S.’s Aaa credit-rating outlook to stable from negative citing the government’s narrower budget deficits.

West Texas Intermediate crude for August delivery even exceeded September Brent futures during intraday trading for the first time since August 2010.Nevertheless, spot propylene prices on a CFR China basis declined $15/ton on the week and offers on a FOB South Korea basis are slightly below the previous week’s done deal levels. For ethylene, spot prices on CFR Northeast Asia basis loosened by $35/ton and offers on a CFR Southeast Asia basis lost $50/ton week over week.

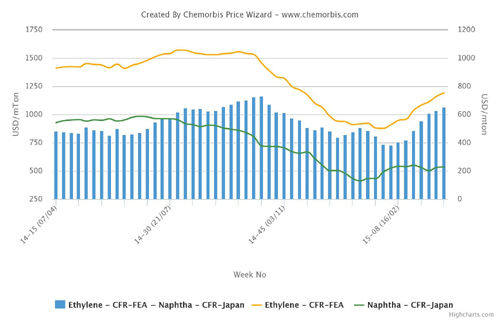

Easing supply concerns were cited as the main reason behind lower feedstock costs. Taiwan’s Formosa Petrochemical restarted its No 1 naphtha-fed steam cracker at Mailiao on July 19 following a brief shutdown. The cracker, which has a capacity to produce 700,000 tons/year of ethylene and 350,000 tons/year of propylene, was unexpectedly shut in the middle of last week after a power outage.

Towards the end of last week, the shutdown of the cracker put a cap on the rise in spot naphtha prices in the region. Spot naphtha prices are more or less stable week over week while they are still suggesting an increase of around $60-70/ton from early July levels.

Besides Formosa’s restart, Thailand’s PTT Global Chemical’s extended LDPE shutdown was cited as another factor behind the drop in ethylene prices, according to ChemOrbis. The company shut its 300,000 tons/year LDPE plant at Map Ta Phut on July 10 after experiencing a technical problem. The plant is expected to remain offline for around 3 months, resulting in an excess of ethylene cargoes in the region until October.