Middle Eastern PE producers initially issued hikes ranging between $20-50/ton for July to China and Turkey with respect to June as per the pricing service of ChemOrbis. However, those producers had to step back from their initial announcements this week taking buyers’ resistance into account amidst generally sluggish activities in both countries.

In China, two Middle Eastern producers adjusted their initial PE offers for the month given lack of strong demand. A Middle Eastern producer withdrew their $20/ton hikes that they had announced for LDPE and LLDPE while they are now seeking rollovers from June. A source from the producer stated, “Our unhealthy sales performance pressured us to adjust our initial targets in the market. Demand remains disappointing even after our revision and we are receiving lower bids from our customers. However, we are planning to insist on our current price levels and hope to see the pricing strategies of other suppliers first.”

A second Middle Eastern producer, who initially announced $40/ton increases on their LLDPE and HDPE prices, moderated their hike targets to $20/ton before achieving some deals. “We had to lower our initial July offers for both products, while buyers keep showing stiff resistance to our revised prices,” a source at the producer stated. “Some of them finally conceded to purchase at these levels in order to fulfill their purchasing volumes in accordance with their long term cooperation agreement,” he continued. The producer, in the meantime, is currently operating their production lines at around 30-40% capacity due to a feedstock shortage.

A trader in Taizhou commented, “We only have Middle Eastern LLDPE as import cargos. However, we received lower counter bids, around $10-30/ton below our targets amidst resistance from one of our customers.” A different trader in Ningbo also mentioned, “Even though we are offering Middle Eastern HDPE film at more competitive levels than the producer of this origin, demand remains unhealthy. Therefore, we plan to remain cautious about our fresh purchases over the near term.”

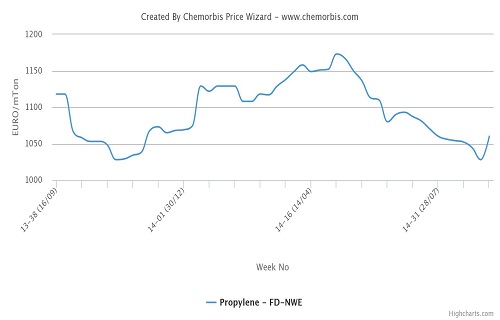

In Turkey, PE converters received higher July prices from their regular Middle Eastern suppliers last week. This week, they could obtain some discounts from initial announcements depending on the product as suppliers lowered their targets considering limited activities due to the high dollar currency, rapidly approaching Ramadan and ongoing cash flow issues.

A packaging converter reported obtaining a $40/ton discount for HDPE film from a major Middle Eastern producer this week after initially receiving $20/ton hikes for July. “However, our supplier remained firm on their LLDPE c4 film prices,” he noted. His end product business is quite active and he is happy with his orders nowadays, he said, predicting that the market will follow a stable trend in the near term.

A second packager received $20-30/ton discounts for LLDPE c4 film from the same producer after initially receiving $50/ton increases from June. “The PE market may follow more or less a steady trend after these discounts,” he commented. The buyer also added that his end product business is not so vivid, rather it is normal to quiet at the present.

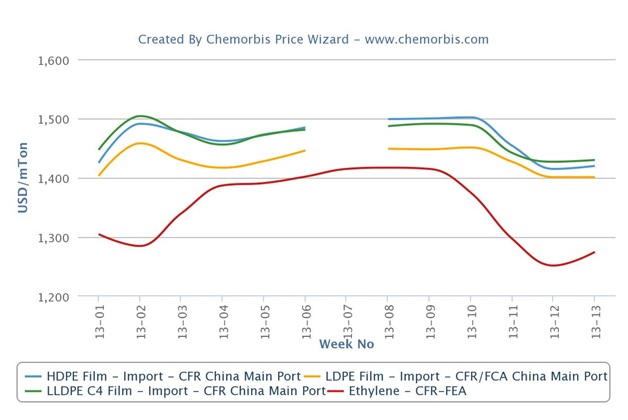

On the sellers’ side, a different Middle Eastern producer reported revising their LLDPE c4 film prices down by $20/ton from the initial July levels. “On the other hand, we almost sold out our LDPE film allocation for this month at prices equal to our initial sell ideas as LDPE demand is stronger than LLDPE demand. Plus, we are not facing any real competition from Iran for this product. However, for LLDPE, slow demand and strong competition from Iranian sources forced us to step back,” a producer source commented. He further added that they may have to reduce their LLDPE prices below the $1500/ton threshold if demand remains weak. “We are disappointed with the state of demand in July as we had been expecting stronger buy interest. We attribute weak buying interest to widespread cash flow problems in the market,” he ended. The producer had expressed their July sell ideas $10-20/ton above June last week.

Overall, players in Turkey expect prices to hover around current levels with some discounts being possible on deals amidst higher crude prices that hit above the $100/barrel threshold recently and muted demand since the Ramadan is right around the corner according to ChemOrbis. Similarly, Chinese players foresee mostly a stable trend over the near term based on upcoming new PE capacities in Asia, higher upstream costs and still discouraging demand.