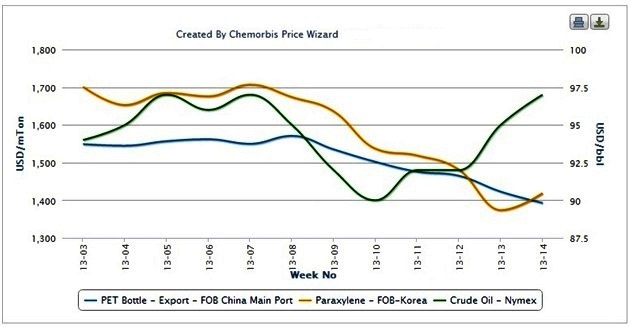

Players in Vietnam are voicing their reactions to the government’s recent decision to lift customs duties on PS from 3% to 5% effective as of May 19, 2013 as per the pricing service of ChemOrbis. Buyers are generally unhappy with the new duties while sellers are divided as to how the new duties will affect trade patterns and pricing within the country.

A distributor based in Ho Chi Minh City said, “We find the government’s decision to raise customs duties on PS to be unjustified as buyers will be deterred from purchasing import cargoes and we believe that this will harm our business.” Another distributor commented, “We do not think that the increase in customs duties will have a large impact on market pricing as sentiment is bearish in the local market and the high season for most PS applications has already passed.”

A third distributor added, “We think that the increase in customs duties will make local prices more competitive than import cargoes and we have already started shifting our purchasing strategy to acquiring more material from the local market relative to the import market.”A trader based in Taiwan expressed their surprise at the announcement of the new customs duties. “We are not sure why domestic sellers within Vietnam pushed for the increase in duties. We are trying to sell as much as we can for now but we are not all that optimistic about the demand outlook for May,” the trader reported.

A converter manufacturing household products said that they are not planning to make any major shift in their purchasing strategy after the increase in customs duties. “We prefer Taiwanese PS to domestic material as we find the quality of Taiwanese goods to be superior. We will watch market developments after the customs duty increase is implemented and we may reevaluate our strategy depending on the gap between the costs of imported cargoes and local material,” the buyer commented. Another household products converter added, “We are unhappy with the decision to raise customs duties as this will push up our costs of production. Furthermore, we do not think that there will be any significant reduction in total imports as the domestic producer’s production is not large enough to satisfy the market.”

According to ChemOrbis, a converter based in Hanoi stated, “The increase in customs duties will not affect us very much as we export most of our end products and will therefore be able to receive reimbursements on the taxes we pay to import raw materials. We think that many other converters will also be able to find ways to avoid paying higher taxes and that the government will not be able to secure any additional revenue from the new tax. We believe that the overall mix of local and import cargoes will not change much as domestic PS production is not high enough to satisfy the market and some converters do not find the quality of domestic PS to be suitable for their uses.”